The Commodities Feed: Specs build silver long

Your daily roundup of commodity news and ING views

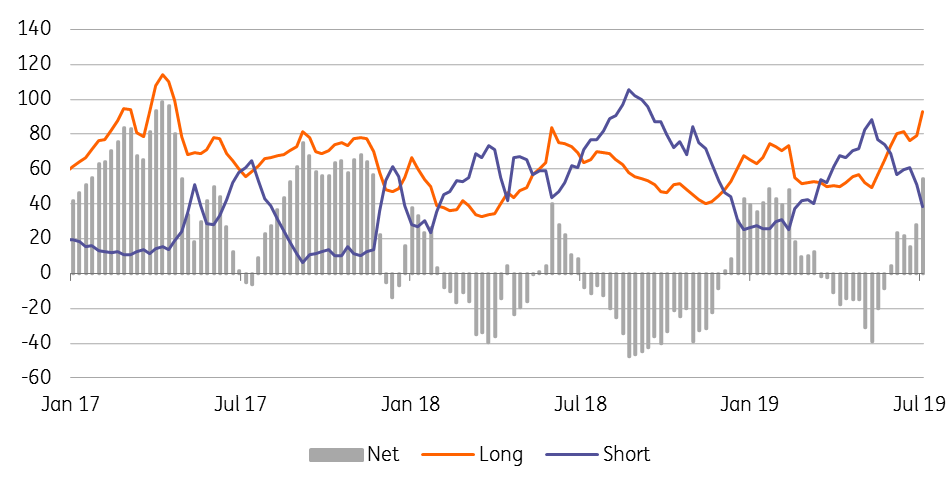

COMEX Silver managed money position (000 lots)

Energy

Speculative liquidation: Latest exchange data shows that money managers sold 24,101 lots of ICE Brent over the last reporting week, holding a net long of 256,319 lots as of last Tuesday. Gross longs dropped by 18,445 lots, while gross shorts increased by 5,656 lots over the week, as speculators turned cautious on oil after the IEA’s executive director, Fatih Birol, said that oil demand growth could be lower at around 1.1MMbbls/d this year. Similarly, CFTC data showed that speculative net longs in NYMEX WTI were down by 28,804 lots over the week with total net longs at 170,840 lots. The majority of selling comes from fresh shorts, with gross shorts increasing by 24,819 lots, whilst gross longs fell by 3,985 lots.

Canadian oil: Alberta has allowed oil producers in the region to increase crude oil production by 25Mbbls/d as existing inventory bottlenecks ease, with the region shipping more oil through rail and pipelines. The latest increment reduces the effective production cuts to 175Mbbls/d currently compared to the 325Mbbls/d cuts that were imposed in December 2018. Supplies are likely to increase further over the coming months as crude-by-rail volume has been stronger on a narrower differential between WCS and WTI. Meanwhile, Enbridge prepares to increase its system transport capacity by around 135Mbbls/d by the start of next year with ‘system enhancements’ at the Mainline and Line 4 pipelines, whilst also expanding capacity at its Express pipeline.

Metals

CFTC report: Latest data from the CFTC shows that managed money net longs in COMEX silver increased by 26,065 lots over the last reporting week, with them now holding a net long of 54,161 lots- more than a one-year high. The general undervaluation of silver relative to gold has seen investors returning to silver, with total ETF holdings also rising sharply over the past few weeks. The buying comes both in the form of fresh longs, with gross longs increasing by 13,279 lots over the week, as well as short covering, with gross shorts falling 12,786 lots.

In base metals, money managers reduced their net short in COMEX copper by 6,671 lots over the last week, now holding a net short position of 30,583 lots as of last Tuesday. This net short is the smallest in nearly three months, as the increasing possibility of rate cuts and stimulus measures in the US and Europe have been supportive for sentiment.

China iron ore: SteelHome data shows that Chinese iron ore inventory at ports increased 0.9mt over the last week, which is the second consecutive week of inventory build, reflecting the improving availability of steel raw material. Increased shipments of iron ore from Brazil and Australia amid softening demand in the Chinese market due to lower margins have helped port stocks to increase in China. Meanwhile, data from the World Steel Association shows that Chinese steel output fell 1.2% month-on-month (up 10% year-on-year) to 87.5mt in June, while global steel output declined by 2.3% MoM (up 4.6% YoY) to 159mt over the month.

Agriculture

Indian acreage: The sowing season is currently underway in India and the trend so far suggests a subdued year due to weak monsoon rains. Data from the Farm Ministry shows that total crop acreage has dropped 6.4% YoY to 68.9m hectares due to rains being 16% lower than the usual for the season so far. Sugarcane acreage is down 5.8% YoY to 5.23m hectares, whilst oilseeds acreage dropped 5.1% YoY to 13.37m hectares. While one would expect that lower sugar production and plans to create buffer stocks of around 4mt could limit Indian sugar exports, the country still sits on a significant amount of stocks, which remains a threat to the world market.

Daily price update

Download

Download snap