The Commodities Feed: Record Chinese oil imports

Your daily roundup of commodity news and ING views

Chinese oil imports grow

Energy

US oil inventories: The API reported yesterday that US crude oil inventories increased by 2.81MMbbls over the last week, which was higher than the 1.9MMbbls that the market was expecting. Gasoline and distillate fuel oil stocks saw drawdowns of 2.83MMbbls and 834Mbbls, respectively. The EIA will be releasing its more widely followed inventory data later today.

The EIA also released its latest Short Term Energy Outlook yesterday, in which it increased its 2019 US oil output forecast from 12.39MMbbls/d to 12.45MMbbls/d, whilst the 2020 production forecast increased from 13.10MMbbls/d to 13.38MMbbls/d. The increase in expectations for this year comes despite the fact that we have seen month-on-month declines in US output for both January and February.

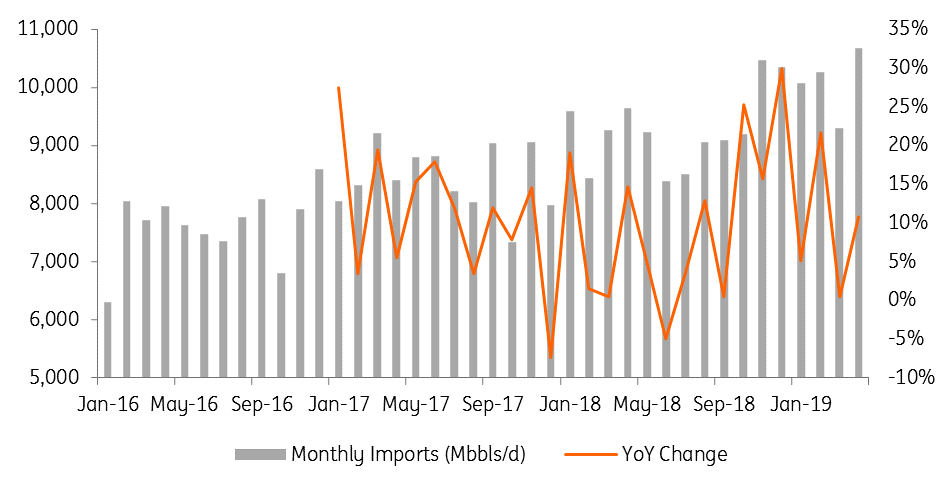

Chinese oil imports: If there are any concerns over a Chinese slowdown, it is certainly not reflected in oil import data. The latest data shows that China imported a record 10.68MMbbls/d of crude oil in April, up 11% year-on-year, and 15% higher month-on-month. Although these strong exports likely reflect heavy stockpiling in the lead up to the expiry of Iranian waivers.

Meanwhile, there were media reports yesterday that Saudi Aramco was set to supply additional crude to Asian buyers in June, with buyers having to turn elsewhere for supply, particularly following the expiry of Iranian waivers on 2 May. This stronger demand for Saudi crude has seen Aramco increase its official selling price for all grades of crude oil into Asia.

Metals

Chinese metal trade: China’s iron ore imports fell 6.5% MoM (down 2.5% YoY) to 80.77mt in April, while YTD imports are down 3.7% YoY to total 340.21mt, as lower shipments from both Brazil and Australia continue to weigh on iron ore supplies in the country. Chinese steel exports were flat MoM at 6.33mt in April (down 2.4% YoY), although YTD exports are up 8.3% YoY to total 23.35mt. For base metals, Chinese exports of aluminium semi-fabricated products over the month remained strong, with shipments increasing 11% YoY to 498kt. This takes cumulative exports to 1.94mt, up 12.9% YoY.

China gold reserves: China added 0.48mOz (14.9 tonnes) of gold to its reserves in April, the fifth consecutive month of additions. April purchases have pushed Chinese gold reserves to 61.10mOz, with 1.86mOz of gold added over the past five months. We believe that strong central bank demand (including from Russia), along with growing uncertainty over trade, should be constructive for gold prices moving forward.

Agriculture

Chinese soybean imports: Latest data from China Customs shows that soybean imports into the country totalled 7.64mt over the month of April, a 55% increase MoM, and 10% higher YoY. In fact, imports over the month were the strongest since September 2018 and the increase is largely a reflection of South American supplies picking up, with harvests underway in the region.

Daily price update

Download

Download snap