The Commodities Feed: Pre-OPEC+ meeting noise

Your daily roundup of commodity news and ING views

Energy

Oil markets continued to rally yesterday, with ICE Brent managing to settle at its highest levels since early March. Attention in the market will turn to the OPEC+ meeting, which is currently scheduled for the 9-10 June. Reuters reported yesterday that the Russian energy minister had a meeting with oil producers in the country in order to hear views around potentially extending deeper cuts into the second half of the year. Under the OPEC+ deal, Russia agreed to cut output by 2.5MMbbls/d over May and June, and then this cut would be reduced to 2MMbbls/d from July through until the end of the year. Comments from the government suggest that Russia will (as usual) prefer to wait and see how the market develops in the coming weeks before making any decision on extending deeper cuts. Given the strength we have seen in the market over the past month, and the expectation that demand will continue to recover in the coming weeks and months, this could also make Russia more reluctant to take further action than what has already been agreed.

The WTI/Brent discount continues to narrow, trading at less than US$2/bbl yesterday, up from more than a US$7/bbl discount in late April. A tightening in the US market appears to be supporting the narrowing in this spread, with US oil production continuing to edge lower, whilst demand is making a gradual recovery, as states in the US ease lockdowns. This has already led to draws in inventories, with the EIA reporting that total US crude oil inventories have declined for the past two weeks, whilst in its last report, EIA numbers showed that Cushing stocks fell by a record amount.

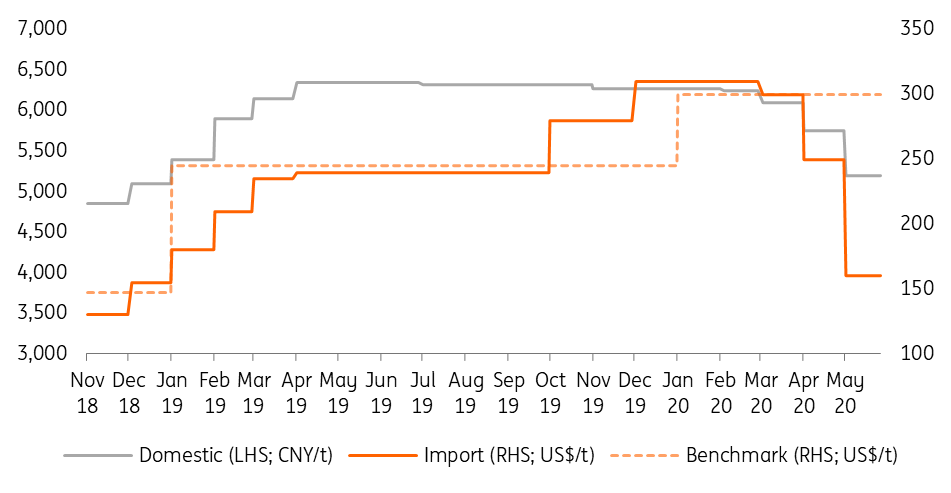

Zinc treatment charges (annual benchmark vs. spot)

Metals

Continued optimism over the reopening of economies along with (rumours of) positive progress on a Covid-19 vaccine have fuelled risk-on sentiment. This has been further bolstered by some bright spots in latest US data, with new home sales and weekly mortgage applications showing some recovery. This has outweighed the rising tension between the US and China. Copper led gains with LME 3M prices trading above US$5,400/t at one point yesterday, whilst the rest of the complex also traded mostly in the green.

According to the latest release from the International Copper Study Group (ICSG), global mined copper production is expected to decline by 3% in 2020, with the group cutting its mine supply forecast by 950kt due to Covid-19 related disruptions. Meanwhile, the latest data from China Customs shows that Chinese scrap imports in April fell 8% MoM to 83kt (in gross weight). We estimate that the contained copper within this scrap totalled approximately 71kt, 10kt lower than March. Total imports during the first four months of the year have reached 260kt, compared to estimated approved import quotas of 432kt as of 18 May. We expect higher scrap imports in May, but this is still unlikely to keep up with the level of the approved quota.

Among other metals, nickel ore shipments declined by 17% MoM and 66% YoY to 1.3mt in April, compared to 3.9mt during the same month a year earlier. The decline in imports was mainly due to lower volumes from Indonesia, where imports fell 82% MoM to stand at just 46kt (vs. 1.9mt in Apr’19) following the nation’s import ban. Meanwhile lower shipments from the Philippines were also seen due to recent mine disruptions and restrictions. Total ore shipments from the Philippines stood at 1.1mt in April, down 41% YoY.

As for zinc, refined imports rose 19% MoM to 33kt in April; however, this was still considerably lower than the same month a year ago, with 78kt imported in April 2019. Zinc concentrate imports, however, hit a record high of 461kt in April (+50% MoM). Although, smelters’ margins have come under pressure recently, with spot treatment charges falling from an average of US$250/t in April to US$160/t currently.

In precious metals, data from Swiss Federal Customs shows that gold exports rose 37% MoM to 132t in April, supported by higher purchases in the US. Exports to the US stood at 112t in April (highest since 2012), compared to 43.2t in March. Among other countries, exports to India and the UK decreased, while no deliveries were made to China for a second straight month.

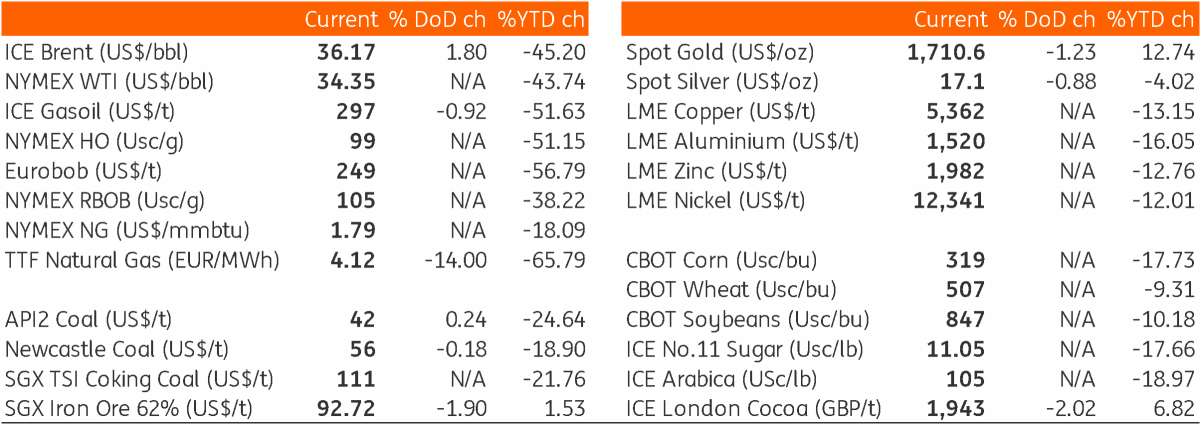

Daily price update