The Commodities Feed: Nickel leads metals lower

Your daily roundup of commodity news and ING views

Energy

The move higher in oil has stalled, with growing noise over what OPEC+ may do when they meet in Vienna on the 5th & 6th December. Unfortunately for the bulls, the noise so far is not the most constructive. Oil companies in Russia are pushing for no change in the current OPEC+ deal, or at least wanting the decision to be postponed until March. The issue is that this would not deal with the large surplus over 1Q20. Then yesterday OPEC’S Economic Commission Board (ECB) reportedly suggested that OPEC does not need to make deeper cuts over 1H20, given that the surplus over the first half of the year will be offset by a deficit in the latter part of the year. As we have mentioned before, OPEC’s ECB offers recommendations, but ultimately it is OPEC ministers who will decide what action to take. We believe that OPEC+ will ultimately extend the deal through until the end of June 2020, and while deeper cuts are needed at least over 1Q20, we feel that it will be a struggle to get all OPEC+ members on board. Ensuring stronger compliance will help, but it will still fall short of bringing the market into balance. Looking at Nigeria and Iraq, if both nations were to comply with the deal it would take almost a combined 280Mbbls/d off the market.

Moving on from second-guessing what OPEC+ may do, and turning to refinery margins. European and Asian margins have been under pressure for some time now, while US margins have recovered somewhat from their recent lows. One of the drivers behind this has been a more buoyant freight market. In fact, in Singapore, hydrocracking margins are negative, whilst in NW Europe they are at their lowest levels since June. If this weakness continues, it should start to hit refinery run rates, which should eventually weigh on crude oil prices. Lower refinery demand should also weigh on time spreads, but for now the ICE Brent Feb/Mar spread remains strongly backwardated.

LME nickel vs Chinese stainless steel

Metals

Concerns have grown following President Trump’s decision to sign two Hong Kong pro-democracy bills. It is not clear how China might react to this move, or whether it could derail ongoing trade talks. These worries have not helped the base metals complex, which came under pressure yesterday. LME Nickel led the move lower, with the metal touching an intraday low of US$13,930/tonne, and then settling at a 4-month low of US$14,010/tonne. The strength seen in nickel prices over much of 3Q19 due to the bringing forward of Indonesia’s ore export ban has inflated the cost of production for stainless steel producers, whilst end product prices have not benefited from the same strength. LME nickel rallied more than 40% following the ban announcement, whilst stainless steel prices only increased by around 12%. Consequently, operating rates at stainless steel plants have been falling, and as a result so has demand for refined nickel and NPI in the Chinese market. Recent market focus has turned back to the realities of the current demand picture, which is also partly reflected in the stainless steel stock overhang in China.

Turning to ferrous metals, Bloomberg data shows that steel mill margins in China recovered to an average of CNY179/t in November, a 5-month high, having been in negative territory for much of October. The weakness in iron ore prices coupled with healthy downstream demand has been supportive for steel margins. Moving forward, Beijing’s support for infrastructure projects and expectations of less stringent winter-curbs may keep iron ore demand relatively firm for the rest of the year and may provide some level of support to an otherwise weak iron ore market.

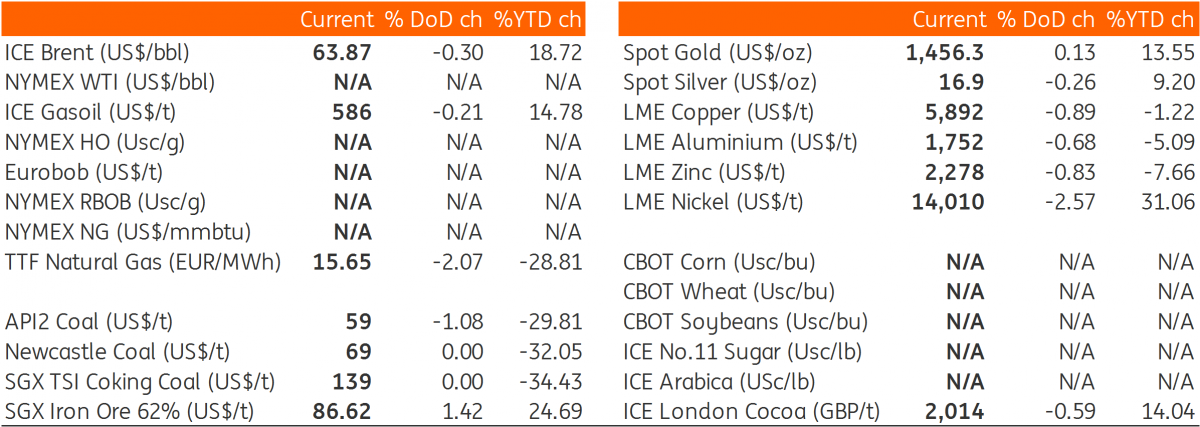

Daily price update