The Commodities Feed: Indonesian copper exports to fall

Your daily roundup of commodity news and ING views

China spot copper treatment charges (US$/t)

Energy

US crude oil inventories: Yesterday the EIA released its weekly oil report, which showed that US crude oil inventories declined by 1.68MMbbls over the last week- less than the 6.13MMbbls draw reported by the API, and less than the 2.7MMbbls draw the market was expecting. However, the big builds were seen in refined products, with gasoline inventories increasing by 8.07MMbbls and distillate fuel oil inventories growing by 10.6MMbbls. These large product builds came despite the fact that refinery utilisation fell by 1.1 percentage point. Product imports increased by 469Mbbls/d over the week, whilst product exports declined by 507Mbbls/d. Given the large builds seen in products, bulls would have been fairly disappointed with the release.

OPEC+ cuts: Despite the relatively bearish EIA release, the market did rally strongly yesterday, following comments from the Saudi Energy Minister that OPEC+ remains committed to keeping the market in balance, and that the agreed cut of 1.2MMbbls/d should be more than enough to return the market to balance. Although he also said that he “would not rule out calling for further action of some kind.” Meanwhile, further support appears to have come from what the market has viewed as fairly constructive trade talks between China and the US.

Metals

Indonesia copper exports to fall: Indonesia’s Energy and Mineral Resource Ministry estimates that copper concentrate output at Grasberg mine will fall from 2.1mt in 2018 to 1.2mt in 2019 as the mine shifts from open-pit to underground operations. As a result, copper ore/concentrate exports from the country are expected to fall from 1.2mt in 2018 to just 0.2mt in 2019. Lower availability of Indonesian ore will tighten the seaborne copper ore market in 2019, which should push spot treatment charges lower once again, after having strengthened over much of 2018 due to smelter outages.

Trade talks & aluminium sanctions: The latest round of trade talks between China and the US has been viewed as modestly positive. A statement issued by the Chinese said that talks were “extensive, in-depth and detailed”. The US statement focused on China’s pledge to resume purchases of US agricultural, energy and manufactured products. Moving away from trade talks, US Treasury Secretary Steve Mnuchin is reportedly set to meet Democrats today to discuss plans to end sanctions against Russian aluminium producer, Rusal. Democrats have asked for the lifting of sanctions to be delayed.

Agriculture

Agri data releases: Brazil’s food supply and statistics agency, CONAB, is scheduled to release its latest estimates for domestic soybean and corn output today. Following the dry weather seen across parts of the country, the market will be watching these numbers closely. In December, CONAB estimated that the 2018/19 Brazilian soybean crop would total 120.1mt, while the market is now expecting a number of around 118mt, according to a Bloomberg survey. For corn, it is expected that forecasts will be revised up from their estimate of 91.1mt in December to around 93mt. Finally due to the partial US government shutdown, the USDA will not be publish its monthly WASDE report, which was originally scheduled to be released tomorrow.

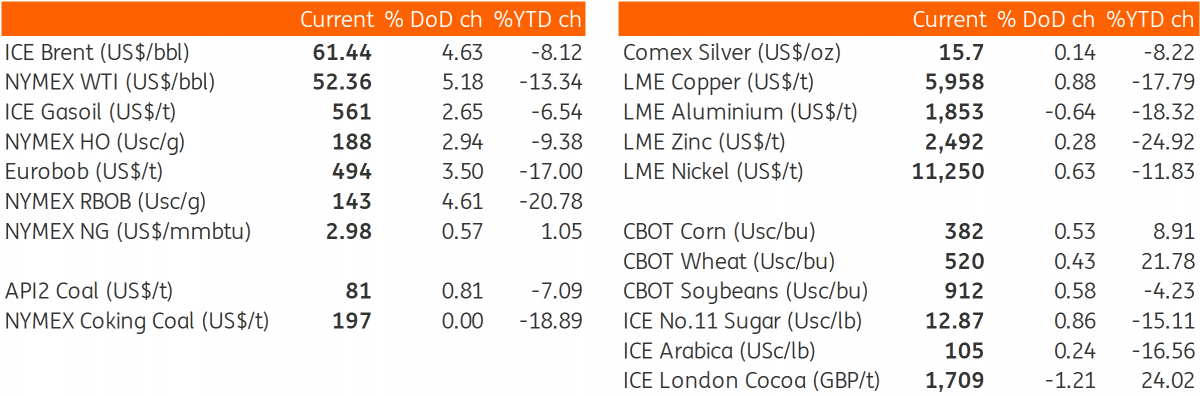

Daily price update

Download

Download snap