The Commodities Feed: Hurricane concerns continue to support the market

Your daily roundup of commodity news and ING views

Energy

Oil prices continued to strengthen yesterday with concerns over hurricane activity in the US Gulf of Mexico (GOM). While Hurricane Marco has weakened, Hurricane Laura is still a worry. The latest data from the Bureau of Safety and Environmental Enforcement (BSEE) shows that 84.3% of offshore oil production in the US GOM has now been shut in, which is equivalent to 1.56MMbbls/d. Almost 61% of natural gas production has also been shut in. In terms of refining capacity in the region, reports suggest almost 3MMbbls/d of refining capacity has been shut in, in preparation for the storm, which is around one-third of US Gulf Coast refining capacity and almost 16% of total US refining capacity.

Finally, the latest numbers from the API show that US crude oil inventories fell by 4.52MMbbls over the last week, which is more than the 2.5MMbbls drawdown the market expected. Looking at products, gasoline inventories fell by a massive 6.39MMbbls, much more than the 1.75MMbbls draw the market was expecting and seems to have provided some support to the RBOB. Later today we will have the more widely followed EIA numbers. But for a view on what the impact from recent hurricane activity will bring, we will have to wait until next week.

Agriculture

CBOT corn pushed higher again yesterday and settled at more than a one-month high of US$3.41/bu (up 2.7%) on the back of poorer crop conditions in the US and stronger import data from China. The USDA reported sales of another 508kt of corn (408kt to China and 100kt to Japan).

Turning to Brazil, and CONAB released its first estimates for the 2020/21 crop, and expectations are that Brazilian corn and soybean production/exports will increase significantly on the back of stronger prices, a weaker BRL and healthy demand. The agency estimates soybean production to increase 10.4% YoY to 133.5mt in 2020/21 on account of higher acreage and better yields. Similarly, CONAB estimates corn production to increase to 112.9mt in 2020/21, compared to 102.1mt in 2019/20, which could see exports rise by 13% YoY to 39mt. CONAB estimates for both Brazilian crops are significantly higher than the USDA is currently forecasting.

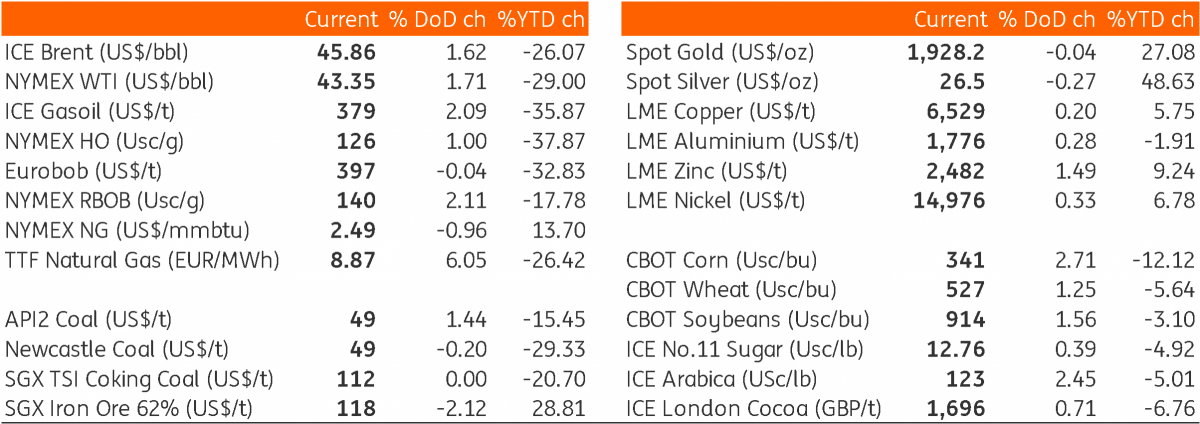

Daily price update