The Commodities Feed: Gasoline takes a hit

Your daily roundup of commodity news and ING views

Energy

The oil market found some support yesterday and this has continued this morning, following the US Fed taking further action to cushion the economic fallout from the Covid-19 virus. Meanwhile growing noise around a potential US-Saudi oil alliance has only provided further support to the market. For now though, an alliance between the two does seem like a pipe-dream. Russian oil producers also met with the Russian energy minister yesterday, to discuss the market outlook. While no decision was made, the head of Tatneft did say following the meeting that it makes little economic sense to increase output in April given the demand hit from Covid-19.

Moving on, and Nigeria crude differentials for April were reduced significantly amid the ongoing price war between Saudi Arabia and Russia. Bonny Light in April will be sold at a US$3.29/bbl discount to dated Brent, which is a reduction of US$4.99/bbl MoM, and is the lowest differential going as far back as mid-2002.

Finally, the gasoline market was hit hard yesterday, with NYMEX RBOB settling almost 32% lower on the day, taking gasoline futures down to the lowest level since 1999. Meanwhile the move also saw RBOB cracks trading into negative territory. This selloff reflects worries over end-use demand due to the Covid-19 virus. A number of refiners in the US have, or are in the process of cutting run rates as a result of weaker demand and refinery margins. Meanwhile Exxon announced that it would also be cutting run rates at two of its refineries in France given the weak products demand picture. As long as there is no improvement in demand, refinery margins will have to remain weak in order to push refiners to reduce run rates further.

Metals

Spot gold prices rallied by more than 3.6% yesterday to settle above US$1,500/oz, and this strength has continued in early morning trading. This strength follows the US Fed announcing unlimited quantitative easing in a bid to support the US economy. Meanwhile gold refiners in Switzerland halted production for at least a week given the Covid-19 outbreak. Gold refineries - Valcambi, Argor-Heraeus and PAMP contribute almost a third to total annual gold supply.

Turning to base metals, and mine supply disruptions from Chile and Peru have done little to support LME copper, with it closing 3.7% lower yesterday. The recent announcements of reduced mining operations in Chile and Peru for 2 weeks is expected to shave off around 1.5% of supply from global output. However for now the market is more focused on slowing demand, which is keeping pressure on prices. In these uncertain times, it is not too much of a surprise to see a move away from risk assets towards safe havens, this is evident when looking at the copper/gold ratio, which has now fallen below 3, and taking it below the levels seen during the Global Financial Crisis.

Finally iron ore saw a pullback yesterday with SGX April futures falling 7.4%, and settling well below the US$80/t level once again. Meanwhile Vale announced yesterday that it was to halt its Asian terminal (Teluk Rubiah in Malaysia), a major conduit to China, as a precautionary measure against Covid-19. However, despite this, the miner maintained its 2020 iron ore targets for both production and sales.

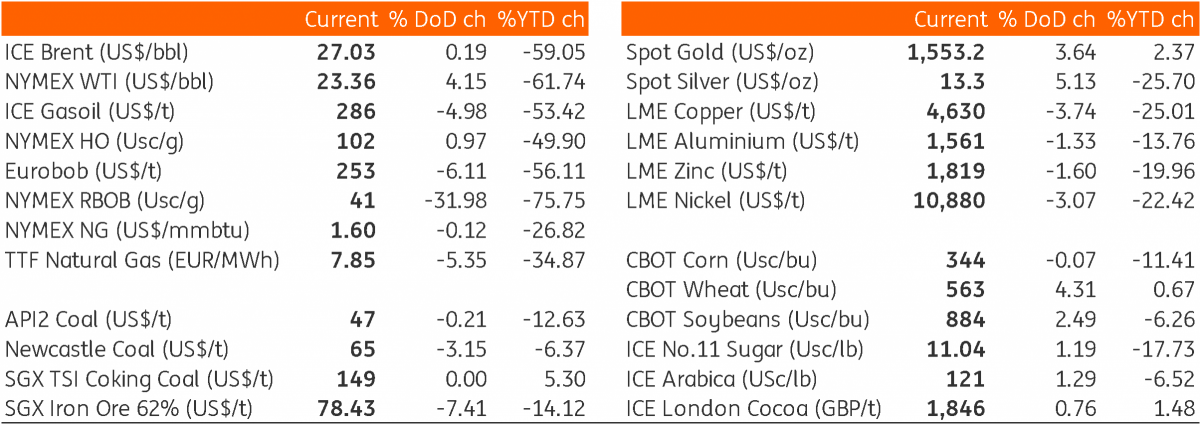

Daily price update