The Commodities Feed: Further hurricane related shut-ins

Your daily roundup of commodity news and ING views

Energy

Oil markets edged higher yesterday with concerns over the impact from Hurricane Marco and Tropical Storm Laura in the US Gulf of Mexico (GOM). According to the latest data from the Bureau of Safety and Environmental Enforcement (BSEE), a little over 82% of offshore oil production in GOM has been shut in, which is equivalent to around 1.52MMbbls/d. Almost 57% of natural gas production in the GOM has also been shut in.

As we mentioned yesterday, these storms also put a large share of US refining capacity at risk, with 54% of US capacity sitting in PADD3. There are media reports of a number of refineries shutting or reducing operations along the Texas coastline. As of now, a little over 1MMbbls/d of refining capacity will reportedly be taken offline as a result of the storm, including Motiva’s 630Mbbls/d Port Arthur refinery, the largest in the US. While refinery disruptions may provide some support to product markets (like we already started seeing yesterday), there is plenty of product inventory out there for the market to draw down.

Finally, the API will release its weekly inventory numbers later today, and expectations are that US crude oil inventories declined by around 3MMbbls over the last week. While on the product side, draws of around 2MMbbls and 600Mbbls are expected for gasoline and distillate fuel oil respectively.

Metals

Metals started the week on a positive note, with dollar weakness providing some support, while markets were given a further boost by hefty outflows in LME inventories yesterday, with copper, aluminium and zinc inventories declining by 5,575t, 1,150t and 1,225t respectively. With copper inventories sitting at just 97.9kt, nearby spreads are vulnerable to volatility. From a fundamental perspective, current optimism is also partly underpinned by expectations that we will see a seasonal pickup in physical demand as we gradually come out of the summer lull. Meanwhile on the supply side, in the US, Nevada Copper has restarted its milling operations at its underground project at Pumpkin Hollow, while in Indonesia, Reuters reports that more than a thousand workers blocked access to the Grasberg mine on Monday.

As for nickel, it led the pack higher yesterday, with LME nickel trading to its highest levels since November. Recently nickel laterite ore prices have been continuously rising amid declining inventories at Chinese ports, leading to the expectation that NPI (nickel pig iron) supply growth will remain under pressure in the Chinese market. Stainless steel margins have also improved recently, which should be supportive for nickel demand. However, not helping the bull case is that stainless steel inventories are still high, whilst Indonesian supply is also adding pressure, with newly-commissioned capacity.

According to the latest data from the General Administration of Customs, China became a net importer of aluminium for the first time since 2009 on the back of rising demand post-Covid-19. Total monthly imports of unwrought aluminium and aluminium products rose 570% YoY to 391kt in July.

Agriculture

China's corn imports increased 136.5% YoY to total 910kt in July, meanwhile YTD imports are up 30.7% YoY to total 4.57mt. We should continue to see strong numbers in the months ahead, with some strong buying seen from China recently. Data from the National Grain Trade Center showed that all of the 4mt of corn offered through the state reserve auction was sold last week; this was the 13th consecutive week of the full sale of auction volumes in China with nearly 52mt of corn offered through auctions since 28 May.

In the US, weekly inspections of soybeans for export increased 24.5% WoW (+19.1% YoY) to 1.15mt last week, with more than half of this tonnage destined for China. Corn export inspections were slightly softer, coming in at 892kt (down 17% WoW). However, this is still significantly higher than the 646kt inspected at this time last year.

Finally, the USDA’s crop progress report showed that the condition of the US corn and soybean crop deteriorated slightly over the week, with 64% of the corn crop rated good to excellent, which is down from 69% in the previous week. While for soybeans, 69% of the crop was rated good to excellent, compared to 72% in the previous week.

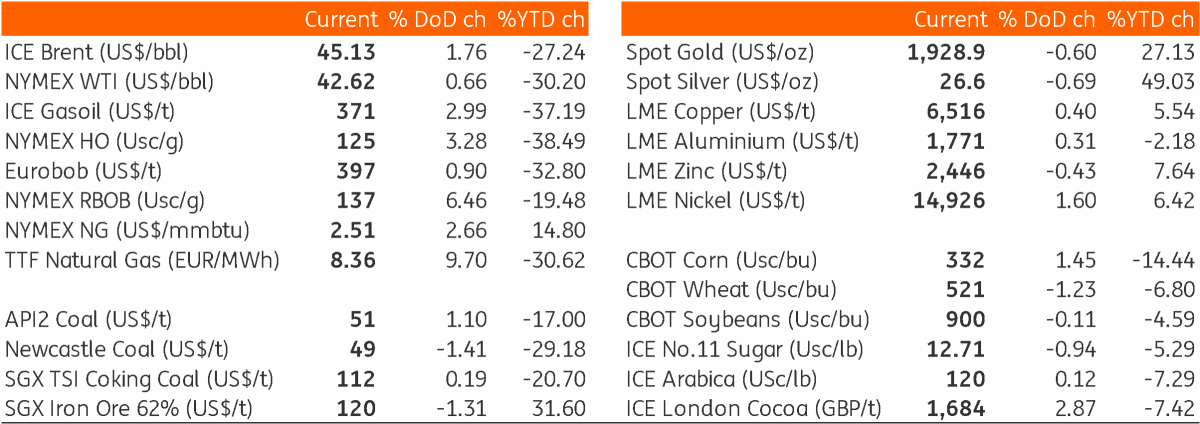

Daily price update

Download

Download snap