The Commodities Feed: Aluminium output falls

Your daily roundup of commodity news and ING views

Global daily average aluminium production (kt/day)

Energy

US crude oil inventories: The API reported yesterday that US crude oil inventories increased by 1.26MMbbls over the last week, which was less than the 3.1MMbbls increase that the market was expecting. Respective draws of 1.55MMbbls and 758Mbbls in gasoline and distillate fuel oil were also reported. The more widely followed EIA report will be published later today, and if an increase is reported here, this will be the fifth consecutive week of builds. Persistent inventory builds in the US, and larger than expected cuts from the Saudis, are likely to continue to weigh on the WTI/Brent spread.

Indian oil imports: Latest government data from India shows that the country imported 19.7mt of crude oil in January. This is equivalent to around 4.66MMbbls/d, which is down 1.8% year-on-year but still up from the 4.62MMbbls/d imported in the previous month. On product exports, diesel volumes totalled 1.84mt, down 32% YoY, and lower than the 2.27mt exported in December. Gasoline exports fell almost 13% YoY to total 1.04mt, but broadly in line with volumes shipped in December.

Metals

Aluminium output falls: Global aluminium production fell 3.5% month-on-month to total 5.3mt, levels last seen in September 2018. The bulk of the decrease was driven by China, where output fell 5.4% over the month to total 2.97mt, whilst ex-China supply declined by 1% MoM to total 2.34mt. The reduction in Chinese output partly reflects winter cuts, but moving forward there will be less impact from this, with some mandatory cuts coming to an end in January. Chinese producer Hongqiao is reportedly in the process of ramping up capacity which was affected by winter cuts.

Chinese ban on Australian coal: Reuters reports that Dalain port in China has banned Australian coal imports, while putting a cap of 12mt on overall coal flows into its ports. The ban has apparently been in place since the start of February and follows reports of other Chinese ports taking up to 40 days to clear Australian coal cargoes. No reason has been given for the ban but it does come at a time of growing tensions between the two nations. The news has seen domestic coking coal prices in China rally, while it is likely to weigh somewhat on the seaborne market.

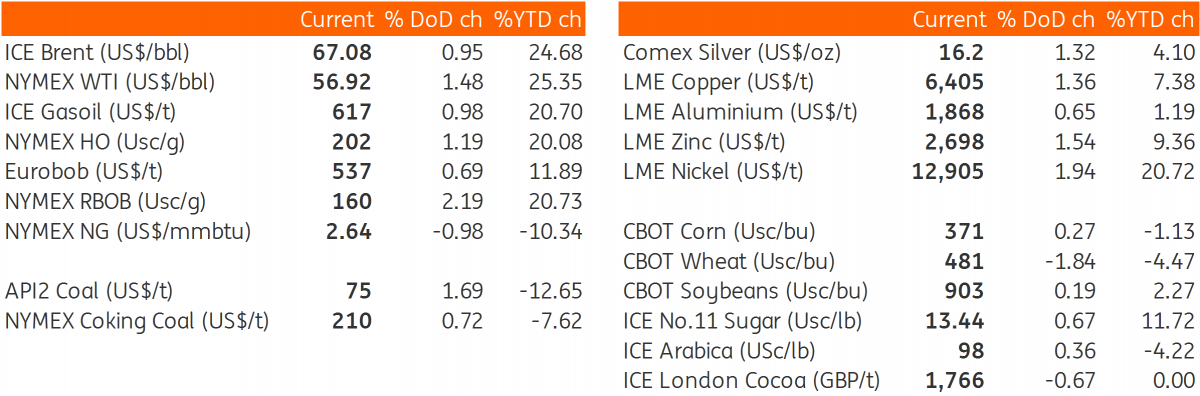

Daily price update

Download

Download snap