The Commodities Feed

Your daily roundup of commodities news and ING views

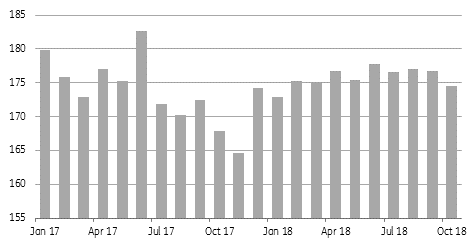

Global aluminium output (kt/day)

Energy

The oil sell-off: The oil market came under renewed pressure yesterday, with ICE Brent settling almost 6.4% lower on the day. Part of the weakness was a result of a broader market sell-off, with equity markets also coming under pressure. However, the aggressiveness of the move suggests that there was more at play here, and there are reports that short put option holders came in to cover their positions. Meanwhile, a statement from President Trump didn't help. He said he'll continue to stand by Saudi Arabia following the murder of Jamal Khashoggi. The president also took the opportunity to say “After the United States, Saudi Arabia is the largest oil producing nation in the world. They have worked closely with us and have been very responsive to my requests to keeping oil prices at reasonable levels – so important for the world.” Following the statement, and the price action yesterday, it does appear that a large part of the market believes that OPEC+ cuts are not a done deal come the December OPEC meeting, with the Khashoggi murder giving the US leverage over Saudi Arabia. However, given the scale of the global surplus over 1H19, we continue to believe that cuts are needed.

US crude oil inventories: The API surprised the market late yesterday, reporting that US crude oil inventories declined by 1.55MMbbls over the week, compared to market expectations for a 3.45MMbbls build. This does appear to have offered some support to the market this morning. Later today, the EIA will release their weekly numbers, and if in line with the API, it would be the first crude oil draw since mid-September. Refinery run rates should see their seasonal increase moving forward, and so the big crude oil builds should be mostly behind us for now.

Metals

Global aluminium output: The International Aluminium Institute (IAI) reported that global aluminium output fell 1.2% month-on-month (+4% YoY) to 174.6kt per day (5.4mt) in October. Chinese production declined 1.9% MoM to 98.4kt/day while output from the Rest of World fell 0.3% MoM to 76.2kt/day. This is the lowest global daily average production number since January 2018, with strong alumina prices and weaker aluminium prices putting pressure on smelting margins. Moving forward, we could see further pressure on global production, as a result of China winter production cuts.

Gold purchases: ETF holdings in gold increased by 23.3kOz yesterday, taking total inflows so far this month to 462.4kOz. The sell-off in equity markets and the prevailing risk-averse sentiment does appear to have increased demand for safe-haven assets. Meanwhile, IMF data shows that central banks, including Kazakhstan, Russia and Turkey added to their gold reserves over October. Russia added 0.96mOz- taking total reserves to 66.43mOz, while Kazakhstan bought 0.2mOz of gold taking their total reserves to 10.97mOz.

Agriculture

Russian wheat exports: Russian wheat exports remain strong year-to-date, up 29% YoY to total 19.2mt so far in the season that started in July. However, according to a number of analysts in the region, the export pace has started to slow more recently. UkrAgroConsult estimate that Russian wheat exports over the first 19 days of November fell by 36% YoY. Given the strong pace of exports earlier in the season, and the smaller crop this season, the export pace was expected to slow. Bad weather has also reportedly hindered port operations.

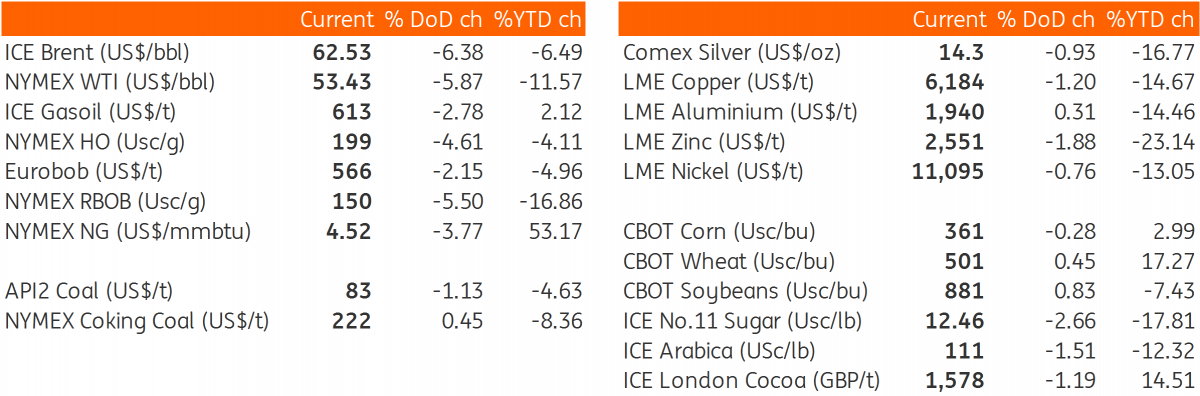

Daily price update