The Commodities Feed

Your daily roundup of commodities news and ING views

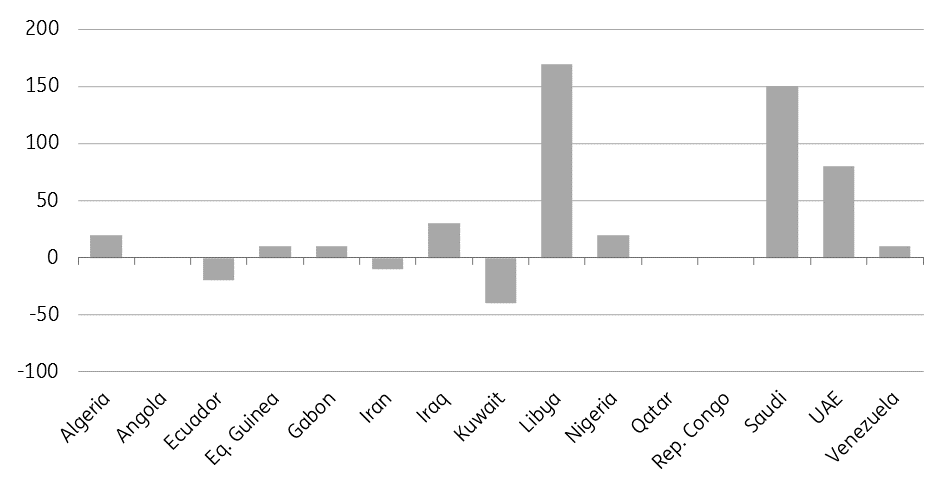

OPEC oil production change - Oct. vs. Sep (Mbbls/d)

Energy

OPEC oil production: According to Bloomberg production estimates, OPEC oil output increased by 403Mbbls/d in October to total 33.33MMbbls/d- the highest monthly number seen since November 2016. The biggest increases were driven by Libya and Saudi Arabia, whose production increased by 170Mbbls/d and 150Mbbls/d respectively. Libya is estimated to have produced 1.22MMbbls/d over the month, levels not seen since 2013. Meanwhile, non-OPEC producer, Russia produced a record 11.41MMbbls/d over October according to government data.

US oil sanctions against Iran: Bloomberg reports that the US has agreed to grant waivers to at least eight countries concerning Iranian oil imports, with India, Japan and South Korea included. China is reportedly included in the eight, but still in final discussions. It is expected that the waivers will be announced later today, ahead of the sanctions coming into force on the 5th November. Meanwhile, Bloomberg tracking data shows that Iranian crude oil exports totalled 1.57MMbbls/d over October vs 1.6MMbbls/d in the previous month.

Metals

Australia met coal supplies: Peabody Energy says that its c.3mtpa North Goonyella coking coal mine may not restart until 2H19, after a fire in late September forced the mine closure. Met coal supplies, especially of higher grade have tightened recently, with prices up from US$182/t at the end of August to US$220/t currently, as healthy steel margins increase demand for raw materials; while prolonged supply disruption offers further support to the market.

Chinese copper premium: Having traded to a high of US$120/t in late September, import copper premiums have fallen to US$108/t recently, while the LME cash/3M spread has fallen from a backwardation of over US$40/t to US$12.50/t currently. This suggests that the tightness seen in the market in previous weeks is subsiding. However macro developments, especially trade talks between the US and China is likely to dictate flat price movement.

Agriculture

Soybeans rally: CBOT soybeans have continued their rally this morning, with the market edging closer towards US$9/bu, following growing optimism that trade talks between China and the US may lead to a deal, with President Trump possibly looking to reach an agreement at the G-20 summit later this month.

The news has led to a heavy sell-off in the Chinese domestic soymeal market. Meanwhile, latest Brazilian soybean export numbers show that Brazil exported 5.35mt of soybeans over October, up 115% YoY, with the increase driven by stronger Chinese demand.

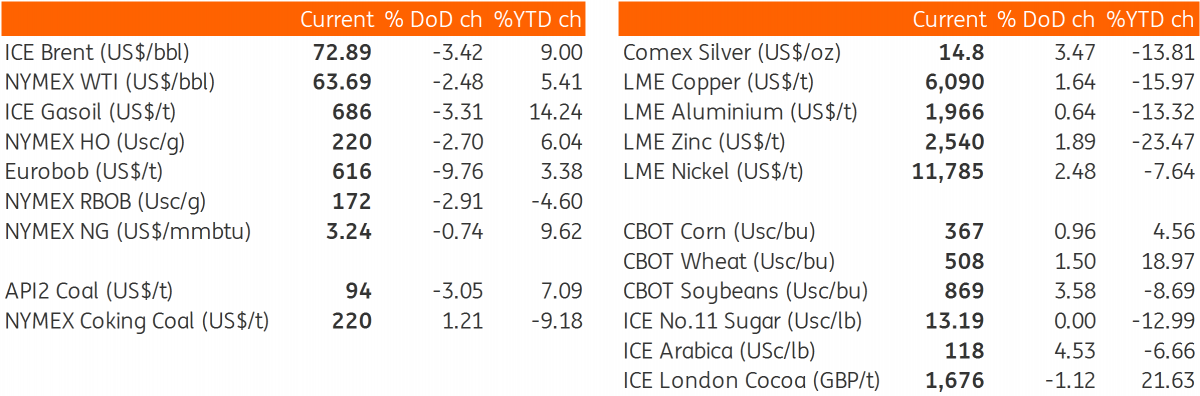

Daily price update