Supply chain strains hold back US manufacturing

The ISM manufacturing index weakened unexpectedly in March as orders and production slowed sharply. Surging energy costs may have played a part, while ongoing struggles with supply chains and labour shortages may also be contributing. Construction is holding up better, but there is increasing caution on the outlook for residential property

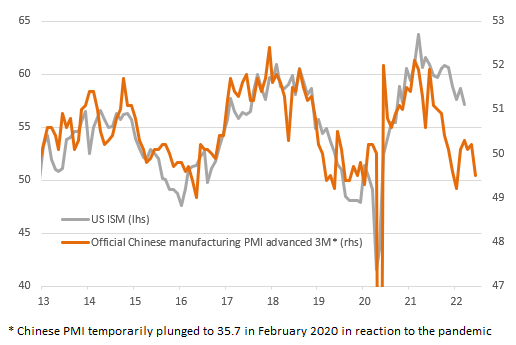

Where China goes US manufacturing follows...

The ISM manufacturing index fell a fair bit further than expected in March to stand at 57.1 versus 58.6 in February. The consensus forecast was 59.0. Regional surveys had indeed pointed to a stronger outcome, but you do occasionally get a bit of divergence. Instead, it is more in line with the declines seen in the Chinese PMI and suggests supply chain strains may be holding back the growth story. The recent Covid containment measures in China mean that supplies of components will remain constricted for the next few months given the lags involved due to shipping, which will constrain output.

Chinese PMI leads the US ISM by around 3 months

New orders were particularly soft, falling to 53.8 from 61.7 while output dropped to 54.5 from 58.5 – both are the lowest readings since May 2020. Inflation pressures continue to build though as prices paid surged to 87.1 from 75.6 on the back of massive increases in energy costs. It may well be that the higher input costs led to customers placing fewer orders and/or businesses holding back in the hope that the energy price shock may settle down. We'll have to wait and see.

Other components highlighted the ongoing supply chain/labour shortage issues with the backlog of orders, while dropping from 65 to 60, still remaining at strained levels. Supplier delivery times are not increasing quite so rapidly, but they are still lengthening and while the customer inventories component improved, they are still way below where they would normally be expected to be. Overall, the growth story is still pretty robust, but those inflation pressures are only getting worse.

Construction still led by residential, but clouds are forming

Separately, construction spending rose 0.5% month-on-month, below the 1% consensus, but there was an upward revision to January's figure to 1.6% MoM from 1.3%. Residential construction rose 1.1% with non-residential contracting 0.1%. Within that, government construction spending fell 0.4%.

Construction spending levels by sector

Overall, it isn’t a bad outcome, but the report does hint again that housing supply is increasing at a time when demand is looking susceptible to weak consumer confidence, the lack of affordability due to record price increases, which is then compounded by surging mortgage rates that could soon rise above 5%. A housing slowdown is a key vulnerability for the US economy in 2023 given our predictions of aggressive Federal Reserve policy tightening that will likely get the Fed funds rate up to 3% around the turn of the year.

Download

Download snap