Strong wage growth bolsters case for Fed hike

Hurricane disruption dragged payrolls negative, but here's why we think a December rate hike is still probable

| -33k |

Change in non-farm payrolls(Previously 169k) |

| Worse than expected | |

Hurricane impact makes job data hard to read

US jobs report has thrown up some fascinating figures, most notably the fact payrolls fell 33,000 versus expectations of an 80,000 gain. However, consider this with a pinch of salt given that the recent Hurricanes may have distorted the numbers.

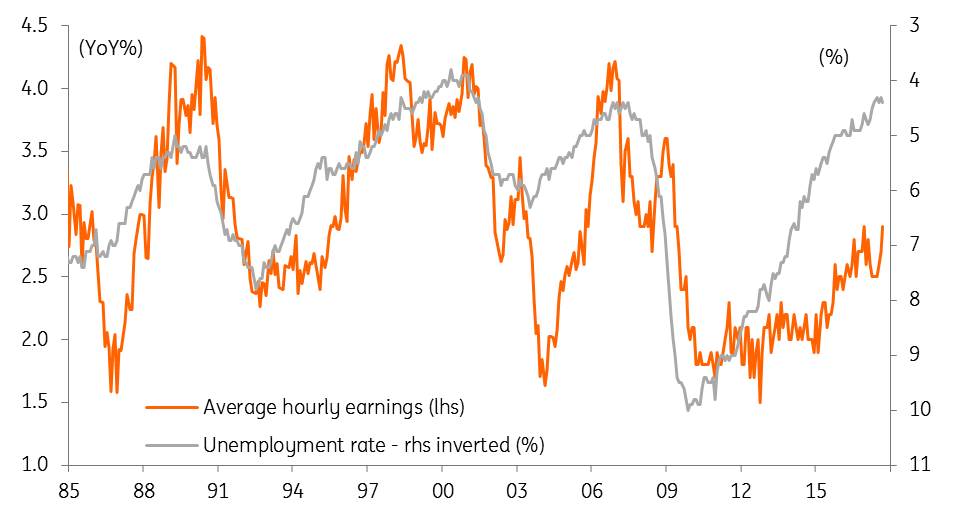

Despite the softness in payrolls, the unemployment rate fell to 4.2% from 4.4%. The other big number is the 0.5%MoM jump in wages – the biggest increase since November 2008 – which takes the annual wage growth number up to 2.9%. There were also some upward revisions to monthly wage rates so we may finally be seeing some of the strength in jobs feeding through into inflation pressures.

Payrolls will bounce back strongly given the Bureau for Labour Statistics suggests that 1.47 million people were unable to get to work because of storm disruption. Moreover, labour demand indicators remain strong in other reports.

| 1.47 |

Workers unable to work due to hurricane(Millions of people) |

Strong wage growth boosts hike probability - but don't forget the politics

Payrolls will bounce back strongly given the Bureau for Labour Statistics suggests 1.47m people were unable to get to work because of storm disruption. Moreover, labour demand indicators remain strong in other reports.

Overall, this positive story on the labour market is only going to strengthen the case for higher interest rates. We already know that the growth outlook is strong – underlined by the ISM manufacturing and non-manufacturing surveys hitting 13 and 12-year highs respectively this week – and inflation is heading back towards target – next week’s headline CPI expected at 2.1% and core at 1.8%YoY.

The arguments justifying higher interest rates is also being broadened with Fed Chair Yellen suggesting “persistently easy monetary policy” could have “adverse implications for financial stability” while warning of “somewhat rich” asset valuations. Relatively loose financial conditions – a flat yield curve and dollar weakness - have been used as arguments that could justify action by other Fed officials.

Tight jobs market drive up wages

Therefore, the main risk to our December rate hike call is politics and the potential for an economically and market disruptive government shutdown. However, we remain hopeful that this can be avoided clearing the way for another two rate hikes in 2018.