Serbia: Will the central bank cut rates?

We look for an interest rate cut from the National Bank of Serbia after a downward revision in its inflation forecast and recent currency strengthening, which should ease depreciation concerns

We expect the central bank to cut the key rate by 25bp to 3.25% given the new National Bank of Serbia's (NBS) inflation outlook. Our call is somewhat against consensus with only seven out of 25 respondents to a Bloomberg survey sharing our view.

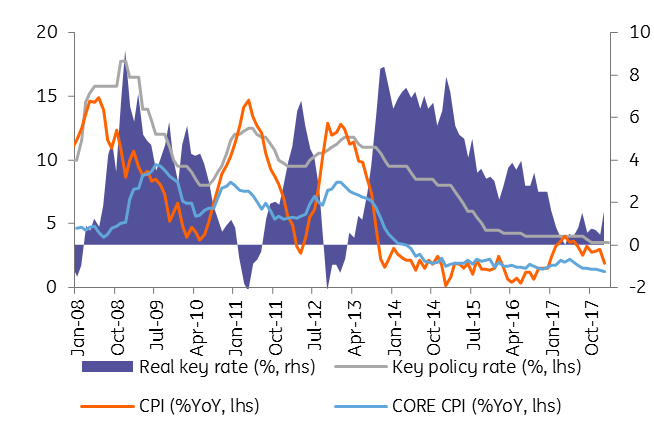

CORE inflation remains below NBS target band

The cut has been somewhat telegraphed, in our view, by Governor Jorgovanka Tabakovic at the presentation of the Inflation Report, who Bloomberg quoted as saying “inflationary pressures point to the need to cut the benchmark rate” as inflation is expected to stay near the lower end of the target band. Recent Dinar (RSD) strength, which prompted NBS FX interventions to curb it, should ease the bank's concerns of exchange-rate depreciation with subsequent pass-through into inflation.

Contained inflation expectations

We believe that any RSD weakness should be short-lived as the monetary policy outlook is supportive for inflows into local currency sovereign debt. We view the fluid external backdrop as the only significant risk to our call. Core inflation well below the NBS target band and the subdued inflation outlook suggest higher relative real interest rates, which along with a firmer RSD would lead to unnecessary policy tightening.

Download

Download snap