Russian Balance of Payments numbers mildly supportive of the ruble

Russia’s strong current account surplus in October amid frozen FX interventions has helped strengthen the ruble. Further gains are possible, but there are risks

| $12.3 bln |

October current account surplus$87.9 bln YTD |

Current account unsurprisingly strong in October on high oil price

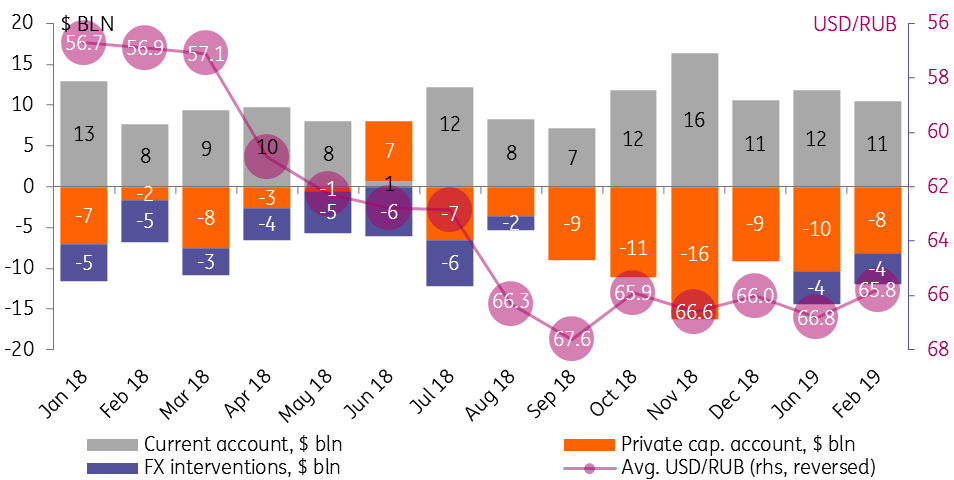

Russia's strong current account surplus of $12.3 bln in October amid frozen FX interventions helped the ruble strengthen by 2.6% m/m to an average of RUB65.9/USD in October. Further strengthening by the end of the year is possible but subject to risks related to private net capital outflows ($10.1 bln in October) and weak OFZ portfolio flows on Emerging Market and Russia-specific risks.

Bank of Russia reported a current account surplus of $87.9 bln for 10M18, which suggests a $12.3 bln surplus in October, up from $8-9 bln per month seen in 3Q18. This result is not surprising given the high $80-85/bbl Brent oil price seen at the beginning of last month after a $75-80/bbl range seen throughout 3Q18. The October result is in line with our view that the 4Q18 current account surplus may reach $30-35 bln under the Brent average of $70-75/bbl.

Remember, unlike the situation of 9M18, when the $76 bln current account surplus was 47% sterilised by the $36 bln FX purchases on the open market in favour of the Finance Ministry, in 4Q18 the current account surplus is not sterilised. In fact, the lack of FX interventions in October enabled the average monthly ruble exchange rate to appreciate by 2.6% m/m (RUB1.7) to RUB65.9/USD in October. This performance was stronger than that of Russia's EM and commodity peers, which according to our estimates posted only a 1.4% appreciation to USD over the similar period.

Capital account weakened in October, limiting the scope of RUB appreciation

Our key concern, however, is with the capital account, which seems to be weakening; the net private capital outflow (by banks, companies and private individuals) accelerated from $6-7 bln in 3Q18 to $10.1 bln in October, the highest monthly figure since March 2017. As with the case of the 3Q18 balance of payments (see our report), we believe this reflects accelerated corporate foreign debt redemption, which however couldn't have exceeded the scheduled $6 bln gross redemption, and some additional outward FDI, mirroring low local demand for investments and persisting sanctions' concerns.

Acceleration in private capital outflow prevents the ruble from benefitting materially from the strong oil-driven current account and the temporary halt in FX interventions, making the local currency increasingly dependent on the local state bonds (OFZ) which have seen total foreign capital outflows of $8 bln since April this year on general EM risk-off and Russia-specific concerns.

Monthly balance of payments (private flows) and USD/RUB exchange rate

As a result, we continue to see USD/RUB returning into the RUB60-65 range by year-end 2018 based on current account fundamentals; the persistent uncertainty regarding EM risk appetite and the possible tightening of Russia sanctions pose an obvious risk to this view.