Russia FX: central bank to the rescue

The Russian central bank has stepped up on the local FX market, announcing FX interventions in addition to the current $100 mln per day sold as per the fiscal rule. This is a reasonable way to address the spike in demand for USD globally and to re-align RUB performance with its EM/commodity peers. However, the mismatch is currently quite low

This morning the Russian central bank (CBR) announced daily sales of FX on the open market, related to the sale of CBR's 50% equity stake in Russia's largest lender Sberbank to the National Wealth Fund. Initially, this deal was supposed to result in sale of c. $45 bln on the local FX market evenly spread over 3-7 years, however, the sharp deterioration of the global market conditions have lowered the value of the equity stake in question to c. $25 bln and apparently called the CBR to immediate action.

Those FX sales will take place at Urals price of below $25/bbl and will come in addition to the daily FX sales attributable to the fiscal rule. The latter has been in place since 10 March and increased from $50 mln per day to presumably $100 mln yesterday (we're expecting confirmation tomorrow, as data is released with a lag), as Urals price dropped from $33-35/bbl to $20-25/bbl and resulted in the deterioration of expected oil fiscal revenues under-collection from $1.0 bln to $2.5 bln per month.

We have the following thoughts on this decision:

- The decision to step up the FX interventions beyond the requirements of the fiscal rule represents a response not to the oil price drop, but rather to the massive global run into USD assets seen yesterday. According to ING's Chris Turner, FX interventions may be on the cards for most of G7 central banks.

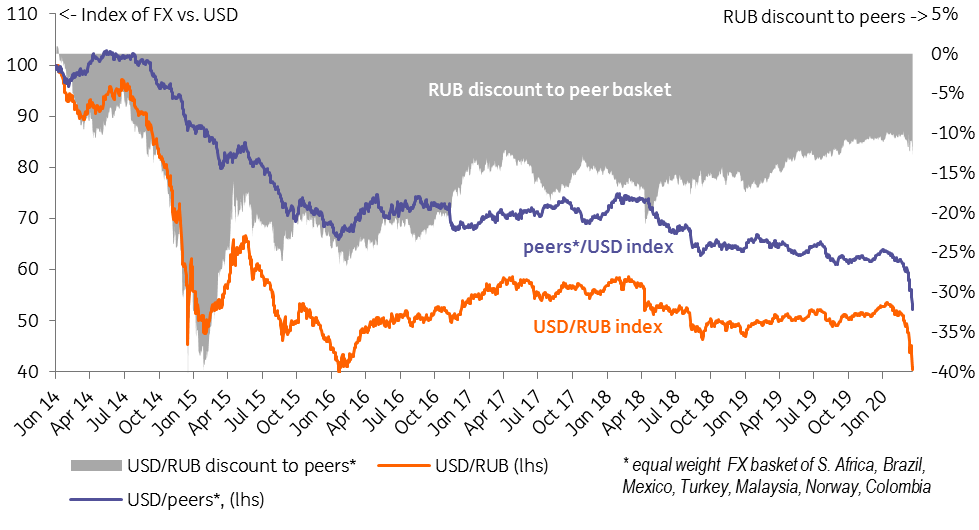

- Additional FX liquidity from the Russian central bank may address RUB's higher volatility relative to its EM peers. We doubt that FX interventions by the CBR are aimed at protecting a certain exchange rate level, but rather to re-align RUB with peers. Year-to-date, RUB lost 22% to USD, being the worst-performing currency in the world, however, other commodity currencies such as MXN, BRL, COP, and ZAR are close seconds, with a -19-22% result. The broader basket of EM/commodity peers that we track (see Figure 1) depreciated 18% since the beginning of the year.

- CBR's actions are in line with the risk scenario it outlined last year, according to which under $25/bbl annual average Urals (with $20/bbl touched at some point) CBR reserves are to decline by $38 bln in 2020.

- The maximal amount of FX CBR can sell, which would be justified by the SBER sale, is currently $25 bln. CBR's total amount of USD-denominated assets was $125 bln in mid-2019 (the latest available data). At this point it is hard to predict the amount of FX interventions CBR will decide on, however, we feel that at this point total FX sales of $200-500 mln (meaning extra FX interventions of $100-400 mln) per day would be large enough to affect market conditions in the short term.

- FX interventions will not remove RUB's sensitivity to the oil price, but may somewhat lower it from the current 1 USDRUB move per $2/bbl.

- The central bank's increased focus on the FX market suggests the lower importance of the policy rate and inflation targeting logic at this point. We take it as another confirmation of our view that CBR is not planning to increase the key rate tomorrow in the current market conditions. The key rate staying flat will represent a higher trajectory relative to a calm market scenario (previously markets expected further cuts) in line with the aforementioned risk scenario.

- We expect neutral bond market reaction to the flat key rate decision. Currently, the market is driven by global flows, that are not motivated by long-term consideration. We also believe that if there's stronger pressure on the global and Russian bond markets CBR will respond through quantitative measures (including OFZ purchases) rather than interest rate tools.

Figure 1: USDRUB is down 22% YTD, slightly underperforming EM/Commodity peers