Russia: CPI pushed down by weak demand

Russian CPI slowed to 5.2% year on year in April - below the March 5.3% YoY peak - due to rouble strength, gasoline price freeze and the apparent weakness in consumer demand. This supports the central bank's recent dovish guidance and makes RUB a watch factor for the pace of key rate cuts going forward

| 5.2% YoY |

April CPI growthdown from 5.3% in March |

| As expected | |

The final reading of April CPI at 5.2% YoY did not come as a surprise, given the preliminary weekly data and the recent indication by the Central Bank of Russia (CBR), that CPI has reached its peak. To remind, on 26 April, the CBR acknowledged the below-expected CPI response to the recent VAT rate hike, but kept the key rate unchanged at 7.75%, also unsurprisingly, citing the still elevated CPI expectations, among other mid-term risk factors. Still, the common perception now is that the CPI is set to decelerate, and the CBR will return to cut rates at some point this year.

Indeed, despite the apparent passing of the CPI peak, households' 12-month CPI expectations edged up a bit to 9.4% in April. We believe it would be more appropriate to treat those figures rather as a measure of the population's perceived current CPI. One explanation to the strong deviation from the officially reported CPI could reflect inertia in perception from the previous months, as well as a lack of trust to official statistics due to differences in individual consumer baskets.

Russian CPI, households' inflationary expectations, and key rate

At the same time, the stubbornness of inflationary expectations may also be explained by the limited scope of the CPI slowdown seen in April. The composition of CPI growth suggests that the only driver for the deceleration was the non-food segment (35% of the basket), where price growth slowed from 4.7% YoY in March to 4.5% YoY to April. This happened thanks to the gasoline price freeze and the RUB appreciation (by 8% to USD in 4M19), with the latter easing price pressure in consumer electronics. The other segments, including food and services, showed no noticeable easing in the price growth.

The positive news is that the gasoline price freeze is now looking to be extended beyond the initially agreed upon 1 July. As we mentioned earlier, there is no official confirmation about an extension, but the discussion of returning RUB200 billion of oil taxes back to oil companies this year and the possibility of increasing the sum to RUB400 billion is an indirect hint at the social priorities of the budget policy at the moment.

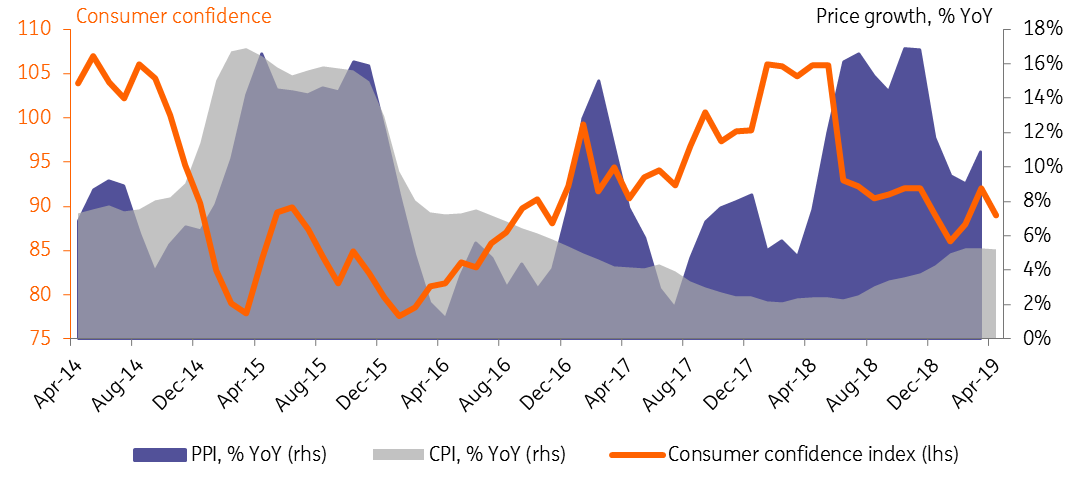

CPI growth by segments

We believe the reason for both the government's decision to assume the rising producer costs and for the weak pass-through of overall PPI (where VAT hike contributed) into CPI, is the same and is related to the weakening consumer trend. Following the post-electoral slowdown in the salary growth since 2H18, the retail trade growth and other metrics of consumer confidence have deteriorated to their 2-3 year lows. We do not expect any material recovery in demand before 2H19, when some indexations in the state sector kick in.

CPI, PPI, and consumer confidence

The weakness in consumer demand and the likely extension of gasoline price freeze into 2H19 justify the dovish shift in the CBR's rhetoric and supports our recent decision to improve the year-end 2019 CPI outlook to 4.6%. However, the pace of the CPI slowdown and the timing of the first rate cut may be affected by the external context. Given the adverse local Balance of Payment seasonality and some headwinds to EM- and Russia-specific risk appetite since May, we see RUB in USDRUB at 65-67 in the next 6 months, preventing a fast deceleration in CPI and making the first key rate cut in September. The more aggressive scenarios currently discussed by some market participants are likely based on a more optimistic RUB view.