Romania: Weak details for 1Q18 sequential growth

The numbers confirm our view of a meaningful slowdown in growth this year from 2017, which is why we don't expect the central bank to tighten in 2018 unless we see the Romania leu heavily depreciate

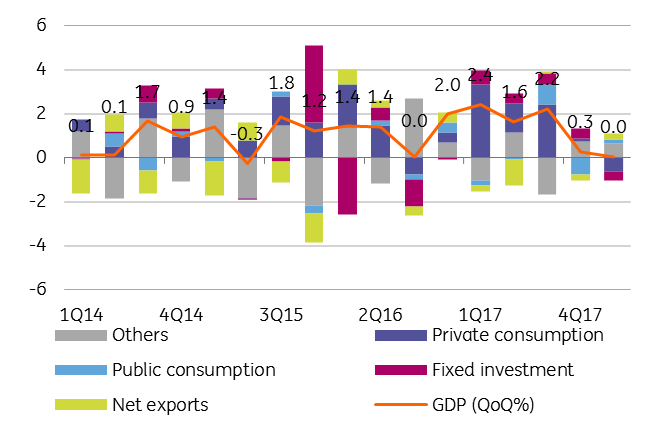

In line with our expectations, private demand contracted by -1.0% quarter on quarter, with proxy retail sales down -1.4% QoQ. Gross fixed capital formation shrunk by -1.8% QoQ. Private demand had a -0.3ppt negative contribution to the 0.0% QoQ growth, while investments declined by -0.4ppt.

Demand side: contraction in private demand

On the supply side, industry contracted by -1.4% QoQ, more than suggested by the -0.6% QoQ decline in industrial production. Construction also surprisingly declined by -0.6% QoQ, while high-frequency indexes were pointing to a 6.9% QoQ rise. Even the star IT&C sector posted a decline of -1.0% QoQ.

The 23.1% QoQ rise in agriculture saved the economy from contraction in 1Q18

The performance in agriculture is likely to be on the back of payments of EU subsidies and is likely to be reversed in the second quarter due to unfavourable weather conditions. Agriculture had a whopping contribution, given its 4.1% share in GDP, adding +0.9ppt to 0.0% QoQ growth, while industry subtracted -0.3ppt, constructions were neutral and private services added a meagre 0.2ppt. Hence, ex-agriculture 1Q18 GDP contracted by -0.9% QoQ.

Net exports had a positive contribution of 0.3ppt after four consecutive quarters of dragging down sequential growth. The supply side paints a broad-based slowdown with agriculture keeping the economy afloat.

Supply side: a transitory boost from agriculture

The GDP breakdown confirms our view for a meaningful GDP growth slowdown from 6.9% in 2017 to 3.5% this year as the consumption engine seems tired. Last year’s formidable agriculture performance which added 0.6ppt to full-year growth is hard to replicate given the weather conditions.

The bad news is that the government has limited resources to boost supply given the fiscal challenges. Moreover, with weaker performance than assumed in the budget plan growth, the government would need additional savings/revenues to keep the budget within the 3.0% of GDP limit.

Due to the soft consumption story, we expect the August National Bank of Romania Inflation Report to show a narrower output gap and maybe a slight downward revision in core inflation forecast. Still, March wage growth accelerated significantly due to the public sector wage hike, and we should see a pick-up in consumption in 2Q18.

The NBR has four more meetings this year, and we are pretty convinced that the central bank will stay on hold both at the July and August meetings. In our view, monetary policy tightening remains unlikely for the rest of the year, unless the Romanian leu comes under heavy depreciation pressure.

But the change in ECB’s stance might be factored in by the NBR at the October and November meetings. We still see more tightening coming next year, in sync with the ECB, and the terminal policy rate at 3.25% in 3Q19.