Romania: NBR holds fire, against consensus

The NBR cited recent inflation surprising to the downside and high uncertainties as reasons for the need for more time to assess the inflation outlook

The National Bank of Romania (NBR) kept the key rate flat at 2.25% and broad monetary conditions unchanged. We were expecting a 25bp hike to 2.50%, similar to Bloomberg consensus, as the latest inflation print at 4.7% required more action to contain inflation expectations, in our view. Some local media commentators suspect political pressure on the NBR. Governor Isarescu dismissed that monetary policy actions are determined by the political backdrop, though it cannot be ignored. The head of the main ruling coalition party said that he submitted some questions to the central bank recently.

The dovish twist in central banks elsewhere, notably in Poland, and inflation surprising to the downside in the EU countries were likely considered, as well as softer high frequency domestic data. The NBR governor mentioned that the “size and pace” of tightening matters waiting to see the full transmission of the previous monetary measures and reiterated that the monetary policy offsetting fiscal measures is not an optimal scenario.

Monetary conditions were still labelled as “accommodative” albeit “less” in the press release, while the latest NBR inflation projection is subject to removing policy accommodation, but the governor mentioned that future decisions remain “data dependent”. At the next meeting on 7 May, the NBR Board will have an updated inflation forecast which is likely to have more hikes as assumption for the projected inflation path. The new forecast is likely to see some minor adjustment lower in the short-term inflation profile, but a broadly unchanged medium-term outlook.

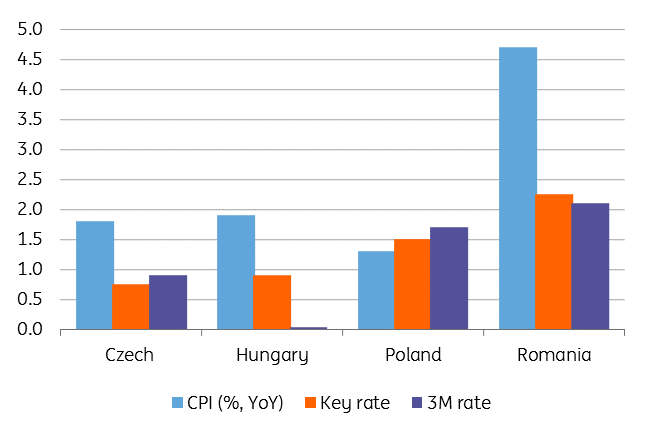

CE4: Interest rates vs inflation

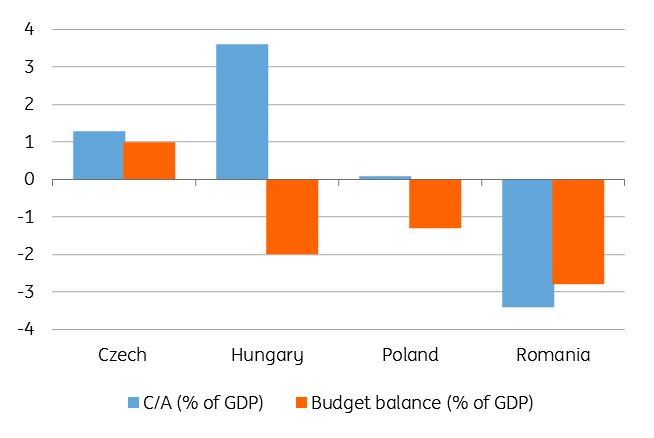

On the currency, the governor mentioned the RON may weaken in the short term as the NBR decision came out against consensus. He reiterated that the NBR is not comfortable with rate hikes leading to currency strengthening which could further widen the C/A deficit. Still, Governor Isarescu considered that the current interest rate differential is enough to cover for the RON risks. The governor warned that most of the liquidity surplus in the money market is transitory and it might vanish towards year-end leading to higher money market rates.

CE4: Twin deficits

We expect the NBR to hike by 25bp at the next meeting and tend to believe that the central bank will take a long pause until there is more clarity on the ECB outlook and tighten in the meantime via liquidity management. So maybe the second hike, which we had pencilled in 2Q18, could be delayed towards year-end if the NBR will hike at all once more this year. We look for more clues in the minutes, due 11 April, but also for a change in the recent unanimous voting pattern.

Download

Download snap