Romania: Lending recovers despite policy tightening

Private lending sped up across the board in January, amid a rising interest rates environment with corporate loans posting the biggest growth rate

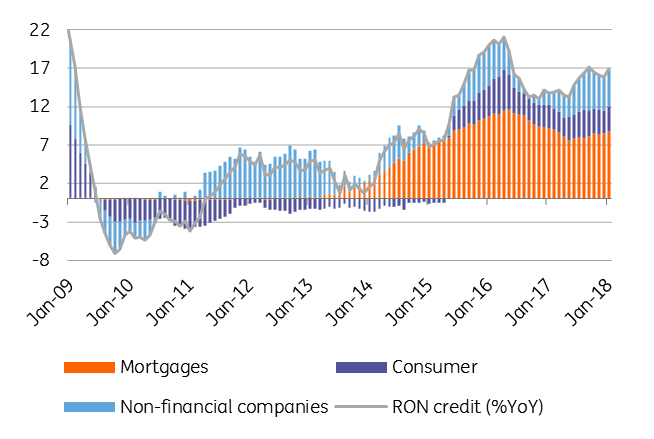

Our credit growth index (adjusted for FX variation) expanded by 6.9% in January year-on-year, from 6.0% in December. Credit in local currency accelerated to 16.9% YoY from 15.8% in December, while hard currency lending declined at a softer pace of -9.9% YoY from -10.5% previously.

Corporate lending index expanded by a hefty 4.2% YoY compared to 2.8% in December while the index for individuals accelerated at a slower pace, from 9.4% YoY in December to 9.7% in January 2018.

Lending growth remains broad based

| 16.9% |

YoY acceleration of lending in local currencyDespite higher interest rates environment |

As noted by the National Bank of Romania in its Inflation Report, the share of RON lending reached 62.8% in January 2018 (the same as in December).

RON mortgages came 36.3% YoY higher while consumer loans were up 10.2%, as both products seem to have stabilised their growth rates in the last six months, despite the NBR’s aggressive tightening in the last part of 2017. The positive surprise came from corporate loans with maturity above five years, which expanded by 6.9% YoY, with the RON component increasing by 27.2% YoY from 21.5% in December.

Though the numbers might reflect refinancing of some FX loans, they are still solid and positive for long-term investments, particularly when considering the lack of government investment spending (government capital expenditures were -50.4% lower than planned, ending 2017 at 2.3% of GDP – the lowest allocation on record, with detailed data available since 2006).

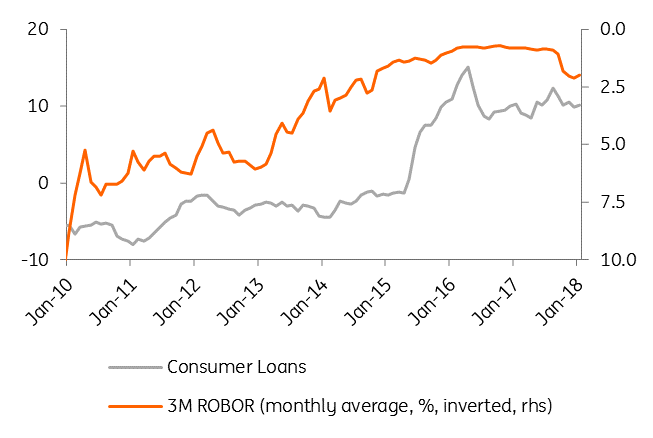

Consumers not giving up loans

All in all, bearing in mind the prospects of negative RON real interest rates for 2018, the consumption/savings decisions seem to be still in favour of the former. Moreover, the sharp gyration south in purchasing intentions for big-ticket items is not reflected yet in the lending data.