Romania: Late party in 3Q, reality check in 4Q or later?

GDP acceleration in 3Q17 was confirmed, but it is backward looking. Forward looking consumer confidence indicator had in 4Q17 the sharpest quarterly fall since 2Q10

Actually, in 2Q10 it was the announcement of the largest fiscal tightening package since the fall of communism, including substantial wage and benefits reductions in public sector, an adjustment of the previous fiscal exuberance. While there is still need of hard evidence before revising our growth forecast, this is definitively worth close monitoring. It looks like the economics are likely to force once more the adjustment of the policy mix with the burden distribution likely to be suboptimal: higher inflation and interest rates, weaker currency and less fiscal rebalancing. The robust European growth backdrop and still a lot of inertia should make the adjustment relatively easy provided policy coordination, but a significant slowdown from the current growth rates looks inevitable.

Consumer confidence collapsing in 4Q17

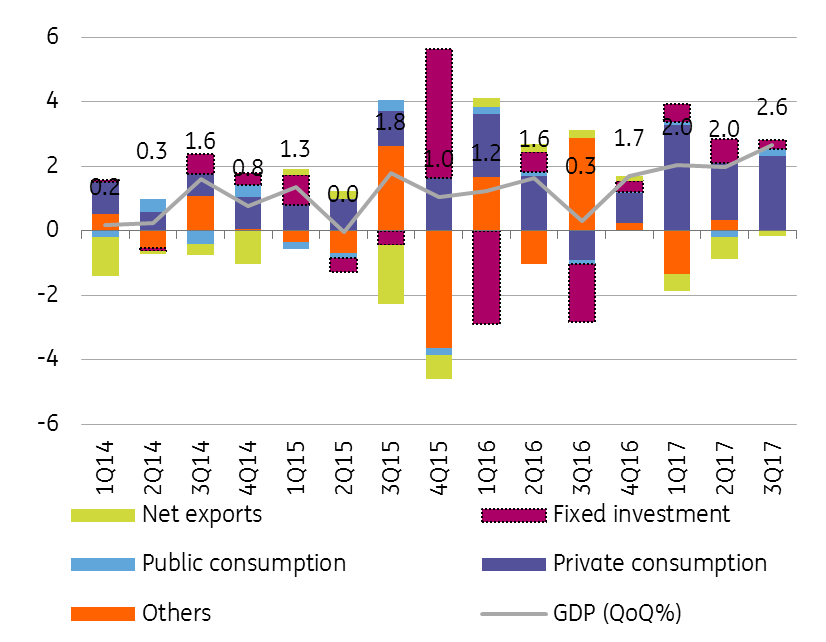

3Q17 GDP growth was confirmed at 2.6%/8.8% QoQ/YoY with the economy expanding 7.0% in Jan-Sep-17 versus the same period of the previous year. Main contributors to QoQ advance were private consumption bringing 2.3ppt out of the 2.6% rate, with investment adding just 0.3ppt, while net exports subtracted 0.3ppt. The annual rate of 8.8% came on the back of a 7.9ppt contribution from private consumption, 2.4ppt from investments while net exports and inventories subtracted 1.2ppt and 0.7ppt, respectively. On the supply side, agriculture had an important contribution of 0.6ppt outmatching services which added 0.5ppt, with industry and construction adding 0.1ppt each to the 2.6% QoQ rate. The annual figure on the supply side was generated by 2.6ppt coming from agriculture, 1.8ppt from industry, 3.3ppt from services out of which 0.4ppt IT&C sector and neutral impact form construction. The data is in line with our FY17 GDP growth expectation of 7.2% YoY.

Consumption driven growth

However, we expect GDP to slow to 4.7% YoY in 2018, based on a number of factors:

(1) Significant monetary policy tightening after the 3M ROBOR interest rate index, relevant for loans, spiked c.150bp over the last three months and potentially underestimated pass-through as transmission improved due to higher share of RON lending (61% of total)

(2) Limited incremental fiscal impulse with budget deficit flat at -3% of GDP

(3) Weaker currency and its potential negative wealth effect (house prices quoted in EUR vs salaries in RON)

(4) Inconsistent public policies, a lower than expected net pay rise in public sector (below 5% vs 25%) and disruption in wage bargaining affecting consumer expectations;

(5) A slowdown in job creation due to a tight labour market and unaddressed structural issues.

Budget plans for 2018 are based on optimistic growth assumptions relying heavily on private consumption and improved tax collection assumptions. This might lead to corrective measures during the year to keep the deficit within the 3.0% of GDP EDP limits, especially if economic growth disappoints. Such measures could be a further drag to growth prospects. Hence, some kind of pro-cyclical vicious cycle ahead for the fiscal policy.