Romanian industrial production feeling the winds of change

2019 started on a weak note for industrial production which contracted in monthly terms by -1.6%. However, with the Eurozone’s largest economy continuing to disappoint, we remain cautious on the growth prospects of the Romanian industry and maintain our view for quasi-stagnation in 2019

The 0.8% year-on-year advance in industrial production could have actually indicated a reasonably good start to the year. Compared to January 2018, all sectors expanded, with the energy sector leading the way and growing by 3.7%, followed by mining +1.4% and manufacturing +0.2%. All good, if it weren’t for the statistical base effects, which were particularly strong for the energy sector.

The total -1.6% monthly contraction has actually been driven entirely by the energy sector which contracted by -3.4% compared to the previous month. As was the case with yesterday’s trade balance data, these developments are likely due to the cap on gas prices approved by the government's emergency decree - the same one that included the bank levy.

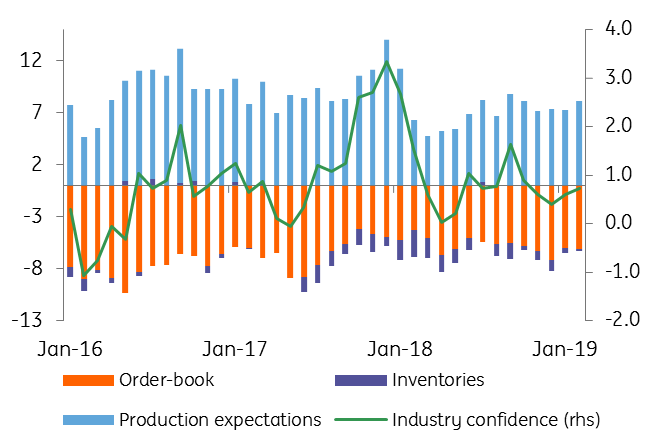

Confidence still resilient

The manufacturing sector confirmed its resilience at lower levels and advanced 0.9% compared to December 2018, while the mining sector performed even better and grew by 1.7%, thus offsetting to some extent the material deterioration in energy and gas.

Industrial confidence recovered slightly in the first two months of 2019, mainly on higher production expectations. However, with the Eurozone’s largest economy continuing to disappoint, we remain cautious on the growth prospects of the Romanian industry and maintain our view for quasi-stagnation in 2019.