Romania Briefing

Liquidity squeeze

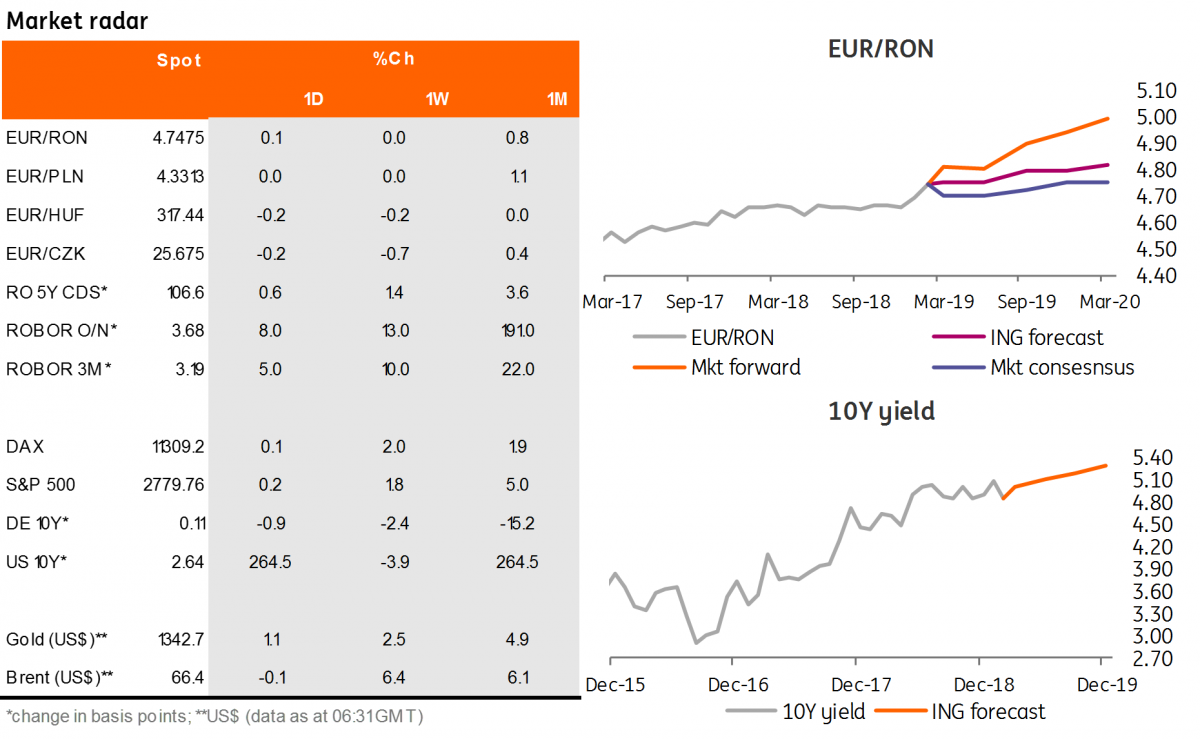

EUR/RON

The EUR/RON traded yesterday within a tight range between 4.7450 and 4.7500 on low turnover and closed somewhere in the middle of the traded interval. We look for a 4.7400-4.7550 range for today with prohibitive cost of carry discouraging RON short positioning.

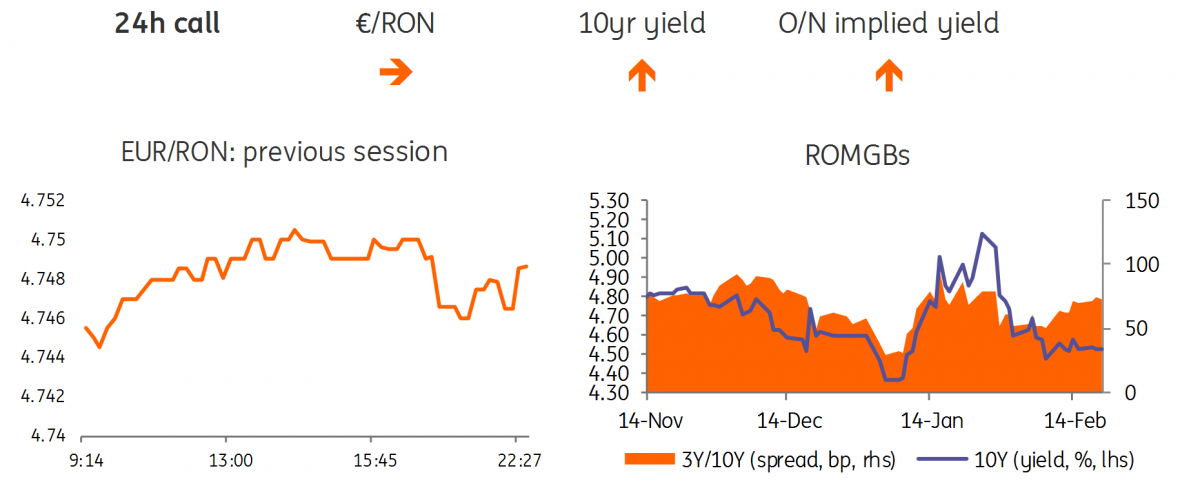

Government bonds

The Romanian government bond yield curve bear flattened yesterday as the front end sold-off due to implied forward yields moving higher across the curve. Front-end yields moved c.10-15 basis points higher, while the back-end was little changed. After the National Committee for Macroprudential Oversight press release did not mention any follow-up meeting or timeline for the “identified solutions for possible scenarios to adapt” the government emergency decree on the bank levy, we could see the market trimming expectations for possible changes according to NBR suggestions to the tax bill.

Money market

The implied funding rates inched higher to 7.00% as we approach the end of the reserve maintenance period and this pushed yields up by c100 basis points up to 1M. The money market curve inverted even more as the upward shift was less ample for longer tenors. A RON5.9 billionn bond redemption on 25 February could offer some relief though it might be offset by payments to the state budget on the same day.