Romania: April economic sentiment reading disappoints

April marks the fourth consecutive monthly drop in the European Commission’s economic sentiment indicator, with services leading the decline.

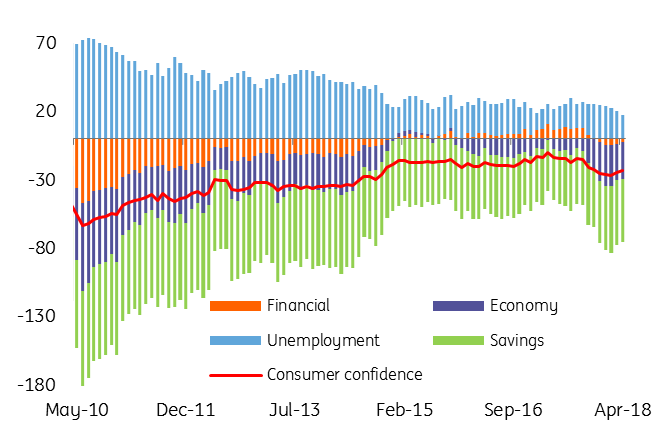

Today’s readings are the weakest since Sep-2014, with most important components of the index sharply lower. Services saw their largest monthly drop since Sep-2013 due mainly to weak business development over the past three months but also on lower expected demand for the coming period. Lower order-book levels took their toll on confidence, while construction and retail followed the downtrend. The only positive in today’s grim data is from consumer confidence which posted a second monthly improvement - the tight labour market making consumers feel more secure about their job prospects. Easter might have brought some cheer as well.

Consumers remain cautiously optimistic

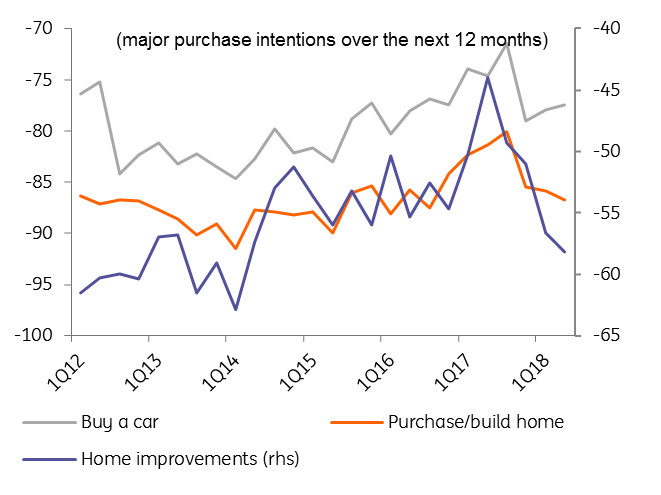

Purchase intentions related to big ticket items continue to decline for 2Q18, with the exception of for cars.

Purchase intentions for big ticket items

After a weak first quarter, it looks like 2Q18 has also started on a weaker note - with external demand affecting industry and internal demand hitting services. This was despite slightly improving consumer confidence. Nevertheless, the stabilisation in Eurozone confidence at the start of the second quarter offers a backstop, particularly for Romanian manufacturing.

ESI points to GDP growth slowdown

Economic data has been catching up with soft data this year and does not paint a bright picture, with slower growth and higher inflation. The first quarter is likely to print a sequential contraction for industry and, absent a strong March (with Easter being in early April), even domestic consumption might decrease QoQ, with construction the only segment picking up. We expect a significant QoQ slowdown in 1Q18 and we cannot rule out a sequential contraction.

Download

Download snap