Romania: 2Q18 GDP growth surprises to the upside

Flash estimates show Romanian GDP rising 1.4% in 2Q18 versus the previous quarter and 4.2% year-on-year. The rebound was stronger than expected but makes the official government forecast of 5.5% GDP look far too optimistic and our forecast of 3.5% marginally pessimistic

Growth above consensus

Flash 2Q18 GDP data shows the sequential quarterly growth at 1.4% versus 0.1% in 1Q18, which translated into 4.2% year on year growth.

The print is above our call of 3.4% and Reuters consensus of 3.8% and comes in line with the latest central bank expectation for the quarterly pace of growth which is “anticipated to regain traction” compared 1Q18. This will make the output gap to “re-embark on a slightly upward trend” but still lower than previously forecasted.

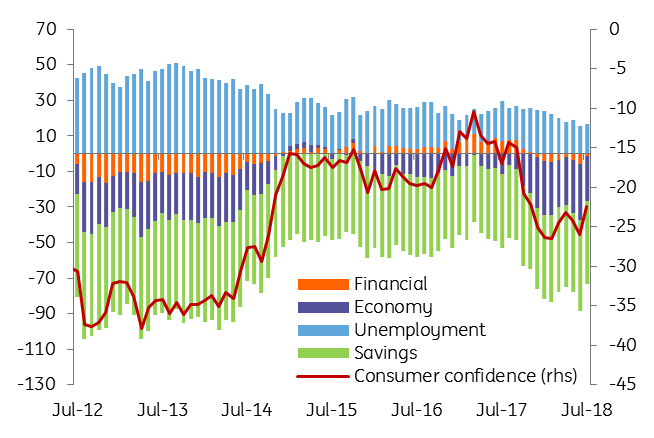

Economic sentiment points to moderation

Drivers are likely to be the same

Private consumption has most likely remained the growth driver while on the supply side we expect decent (but not extraordinary) contribution from services and industry, in line with the recent high-frequency data. Agriculture could also yield some surprises but gauging the impact of recent unusual weather conditions (draught in late spring affecting wheat crops and heavy rains and floods in the first two months of the summer), and the recent outbreak of African swine fever is quite cumbersome.

With the growth in Germany surprising on the upside, external demand should remain solid and compensate for a decline in domestic demand.

Consumer confidence stabilising

While the detailed breakdown is due on 7 September, today’s flash data makes the official government forecast of 5.5% GDP growth for 2018 look far too optimistic.

Also, our 3.5% forecast appears marginally pessimistic now. We see the full 2018 growth closer to 4%, and risks are broadly balanced. From the monetary policy stance, “a somewhat slower reduction in the degree of accommodation” is expected, which could keep household spending afloat, while policy (in)consistency will play an ever greater role on economic sentiment, as two electoral years are approaching.