Rebound in US new orders reassuring for near-term growth

2019 looks set to bring some fresh challenges for the US economy, but for the time being, the latest rebound in the ISM manufacturing survey emphasises that things still look very healthy

Recent Fed commentary has triggered plenty of discussion about where the US economy is headed in 2019. The overall message from the latest ISM manufacturing survey is that things still look fairly rosy.

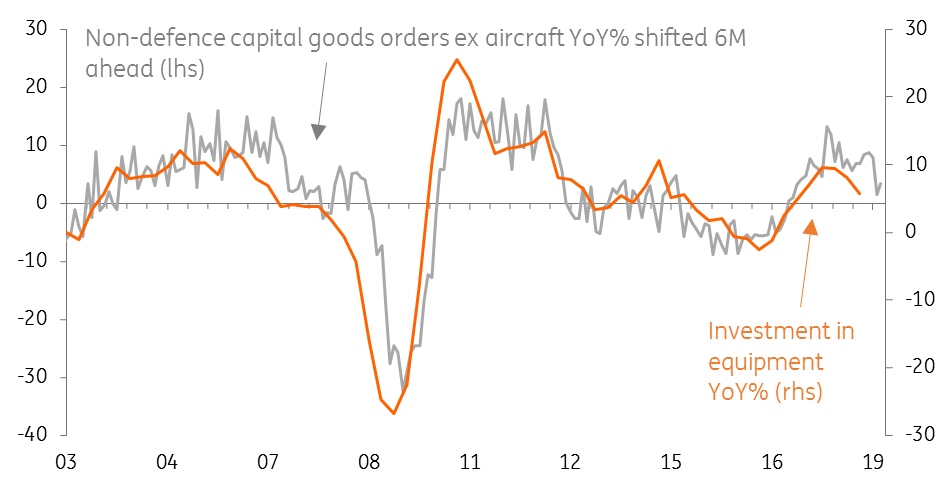

Probably the most reassuring element of November’s survey is the decent rebound in the new orders component – rising from 57.4 to 62.1. Growth in durable goods orders had begun to slow over the past couple of months, raising question marks over the outlook for investment more widely.

Overall message from the latest ISM manufacturing survey is that things still look fairly rosy

Admittedly, there still seems to be a gap between the domestic and external picture – the demand for exports appears to be more restrained, no doubt hampered by ongoing trade tensions. Despite the surprise truce over the weekend, our team are cautious about reading too much into this news, suggesting these headwinds for export-orientated manufacturers are unlikely to fade rapidly.

| 59.3 |

November ISM manufacturing index |

| Better than expected | |

That aside, Monday’s ISM data is a good reminder that the corporate sector remains in decent shape, and that will continue to support growth in the near-term. This is one of many reasons why we expect the Fed to hike rates once again in December.

The ISM data is a good reminder that the corporate sector remains in decent shape

The picture is looking a little hazier as we move into 2019. Higher borrowing costs are beginning to take their toll on the housing market and construction, while a stronger dollar and fading tax cut effect will also weigh on momentum to some extent. Overall, we expect economic growth to slow modestly to 2.4% next year.

But with the strength in wage growth likely to persist next year as skill shortages intensify, we continue to expect the Fed to implement three further 25bp rate hikes throughout 2019.

The recent trend in new orders growth has been slower