Poland: Sound 2Q GDP but investment disappoints

Consumption remains the main diver of GDP. Investment remains weak, stat office claims methodological changes matters. We expect their gradual acceleration in coming quarters

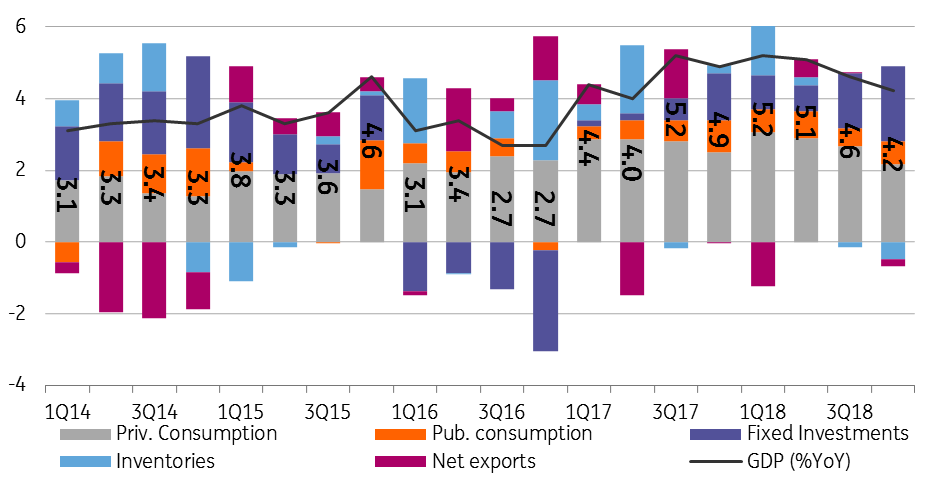

The second estimate of 2Q GDP confirmed a slight decline from 5.2% to 5.1% year-on-year. Domestic demand, with the dominant contribution of consumption (2.9 percentage points), is still the main driver of growth. The contribution of net exports improved (+ 0.5pp) due to a rebound in German and Polish industry in 2Q18 after a weak 1Q18.

| 4.5% |

Investment (YoY)A disappointment given solid rise in local government and large companies, stat office said methodological change matters |

| Worse than expected | |

The most important element in the data was the deceleration in investment to 4.5% YoY from 8.1%, despite growth in local government spending (in 2Q18 nominal increase of 83% YoY) and double-digit increase in investment spending of large companies (14% YoY). This suggests very poor investment outlays of small and medium-sized enterprises. Investment decisions without the election factor and outside of large companies are very cautious. This weakness in 2Q18 may be caused by the launch of new regulations on VAT in July (so-called split payment effectively freezing some working capital) as well as regulatory and legal instability. Also the statistical office said it changed the methodology for military outlays, though this doesn't seem enough to explain the 4-5pp miss vs forecasts.

Public investment should remain solid but it would be hard to expect steady growth of 30% YoY at the beginning of the year. Hence the revival of company investment outlays, including SMEs, is an important element that should helpt to boost GDP growth in coming quarters.

In our opinion, GDP growth peaked in the first half of 2018. In 2Q18, we expect an average GDP growth rate of 4.4% YoY due to a slower pace of consumer spending and a lower contribution of inventories. The contribution of net exports in the euroland should be slightly positive or close to zero. Still, a sound GDP outlook does not change the MPC's dovish outlook (we see flat rates until 2020) as CPI in 2019 is unlikely to challenge the MPC's target.

GDP growth (%YoY) and contributions (in pp)