Poland: Strong growth, looming investments and inflation weakness

Strong GDP growth together with subdued core inflation call for flat central bank rates for a while. Also, a Goldilocks economy makes Polish government bonds resilient despite the recent risk-off in global markets

GDP

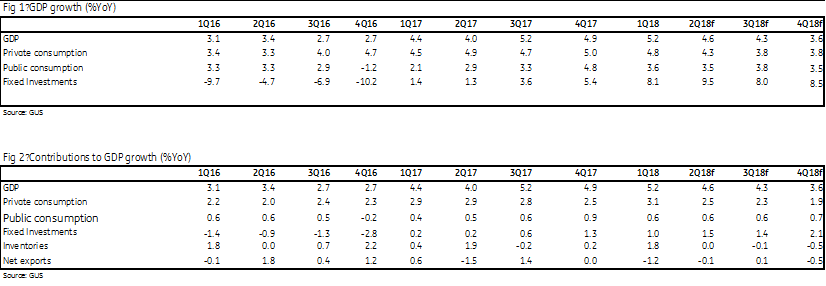

According to the first full estimates, 1Q18 GDP grew by 5.2% year on year vs 4.9%YoY in 4Q17, In quarterly terms, GDP hit 1% quarter on quarter (1.6%QoQ in 1Q18) for the sixth time in a row. The Eurozone soft patch negatively affected net exports, and at -1.2pp, its contribution was the lowest since the last few quarters. But the Polish economy is racing ahead with sound domestic demand rising by 6.8%YoY - the highest since 1Q08.

According to a World Bank report, Poland is one of the most successful transition economies among all emerging markets in the last few decades, and this is now paying off despite the recent controversial policy agenda.

| 5.2 |

1Q18 GDP (%YoY)Revised upward by 0.1pp vs. flash estimate |

| Better than expected | |

However, the structure of domestic demand was somewhat unsatisfactory.

Consumption keeps growing at a very high pace of 4.8%YoY vs 5%YoY in 4Q17, and its contribution (3pp) was the highest among all GDP components. This is mainly driven by a sound labour market, the child benefit subsidy and meagre saving rates. The recent social policy agenda has increased household confidence and caused savings rate to drop to zero at a relatively early stage of the business cycle. This is a less risky version of consumption boom, not driven by leverage and credit but fuelled by fiscal impulse and low saving rates.

Investments also grew by 8.1%YoY in 1Q18 vs 5.4%YoY in 4Q17.

We find the investment dynamics unsatisfactory, given the very high level of capacity utilisation. Also, the contribution of investments to GDP dropped to 0.9pp vs 1.4pp in 4Q17. The right tax policy, changing law and new burdens to be imposed on companies including VAT split payment, higher pension contributions, and the launch of the occupational pension scheme are decreasing companies propensity to invest.

The PLN280bn of EU projects in the pipeline should speed up public outlays and also revive private investments in the coming quarters, so we remain optimistic. Finally, inventories contribution was 1.9pp - also the highest since the last few quarters.

GDP and its structure (%YoY)

GDP data (%YoY)

Inflation

According to a flash reading, CPI accelerated from 1.6%YoY to 1.7%YoY in May, below market consensus (1.9%YoY).

The major move came from fuel prices, which increased by 9%YoY vs 1.4%YoY in April and mainly reflects the rise of oil prices after the US's withdrawal from the Iran agreement. On the other hand, food prices recorded a greater slow down than estimated - from 4.1%YoY to 3%YoY vs ING forecasts at 3.6%YoY.

Based on the GUS comment, we estimate core inflation to stay flat compared to May (0.6%YoY) and below the market consensus (0.7%YoY). This underlines a virtually non-existent transition of wages into prices. The core component dynamic was likely to have been supported by a recent change in the methodology of clothing (adding about 0.1pp to the YoY dynamics), as well as seasonal shifts of package holidays prices.

Therefore the headline figure suggests growth of services prices is stagnating, or even decelerating further.

CPI (%YoY) and its structure

Looking ahead we expect the June headline inflation reading to exceed 2%YoY, again on the back of fuel prices. Given the external source of price growth and softness of the core component, the central bank should see no reason for eventual policy tightening. Furthermore, from July onwards inflation is likely to slow down as base effects will weigh on the headline figure.

Overall, today's data shows sound GDP growth (with slight unsatisfactory structure) and subdued core CPI. So it supports the central bank's forward guidance on flat rates until 2020. Also, a Goldilocks economy makes Polish government bonds resilient despite the recent risk-off caused by Italian political turmoil.