Poland: Solid activity data, cloudy outlook

Industrial production outperformed expectations in April. Still, a drop in new orders (especially exports) is alarming

| 9.3 |

Industrial production (%YoY) |

| Better than expected | |

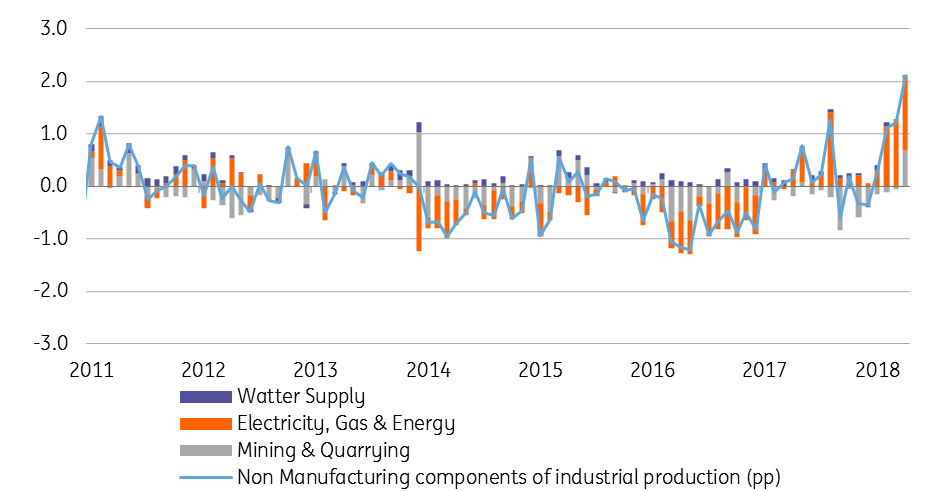

Industrial production accelerated from 1.8% year on year to 9.3% (slightly above market consensus 8.5%YoY). On a seasonally-adjusted basis, the improvement was small, with the headline figure accelerating from 5.1%YoY to 5.9%YoY. The official statistics office GUS highlighted a recovery in the export sector after a soft March, with machinery accelerating by 17%YoY and furniture manufacturing by 14.9%YoY. Sentiment in construction-led segments (production of base metals and non-metallic minerals like concrete etc.) showed above-average growth. Finally, a solid contribution came from the mining and utilities sectors (total contribution was close to 2pp).

Strong contribution of mining and utilities sector

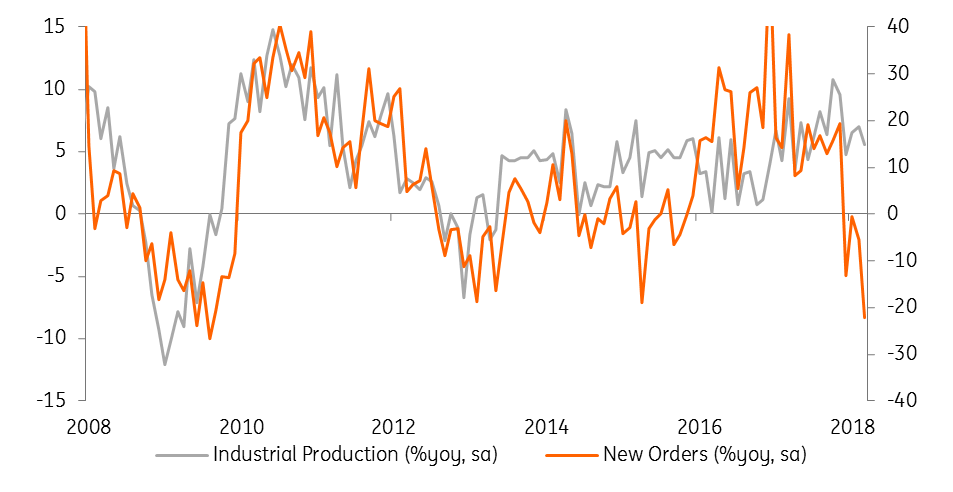

Looking ahead, we expect a moderation in industry. In recent months, there has been a strong deceleration in the new orders portfolio including external demand. The slowdown in demand growth raises doubts about sentiment in Eurozone economies.

Drop of new orders is alarming

Construction output increased from 16.2%YoY to 19.7%YoY but missed the median call of 24.8%YoY. Growth in the civil engineering category came in at 22%YoY (vs. 30%+YoY in 1Q18) due to delays in infrastructure investments. Data underlines the solid performance of the real estate sector with building construction growing by 30.6%YoY.

| 4.6 |

GDP growth (%YoY) in 2Q18 - ING forecast |

Today's data is consistent with a moderation of GDP growth in 2Q18. We expect a deceleration from 5.1%YoY to approximately 4.6%YoY.