Poland: Robust retail sales and production support solid GDP growth

January activity data remains consistent with 5% year on year GDP growth. But the central bank's reaction is likely to be benign as inflation hovers below 2%

| 5.0% |

ING GDP forecast for 1Q18(%YoY) |

January activity figures support GDP growth close to 5%YoY in 1Q18 vs 5.1%YoY in 4Q17. Growth structure is likely to be more balanced – as retail sales indicate a substantial contribution of private consumption, and acceleration in construction sector bodes well for investments.

Industrial production

Industrial production accelerated from 2.7% year-on-year to 8.6% YoY close to consensus expectations (8.5% YoY).

The discrepancy in the dynamics between the December and January reading is due to the difference in working days (-2 in December vs +1 in January, what accounts for 6pp).

In seasonally adjusted terms, production slowed down from 7.3% YoY to 6.2% YoY. The Główny Urząd Statystyczny's (GUS) comments indicate the strong performance of the export sectors (i.e. manufacturing of machinery – 16.9YoY%, electronics -14.3%YoY, furniture – 12.2%YoY) after a relatively soft December. Secondly, production was closely related to construction sector achieved above average performance. (i.e. metals 16.5%YoY and non-metallic minerals -22.8%YoY).

| 10.2% |

ING investments forecast for 1Q18(%YoY) |

Construction output

Construction output expanded by 34.7% YoY vs 12.7% YoY in January. And February data from this sector has limited relevance - due to weather conditions, the volume of work was much lower usually 50% in 2018, but 34% below the typical annual average.

We expect March data to reflect better the underlying pace of investments realisation (output this month is 20% lower compared to the annual average). The structure of industrial production presents a healthy positive outlook. Overall we expect 1Q18 investment to increase by 10.2% YoY vs 11.4% YoY estimated for 4Q17.

Retail sales

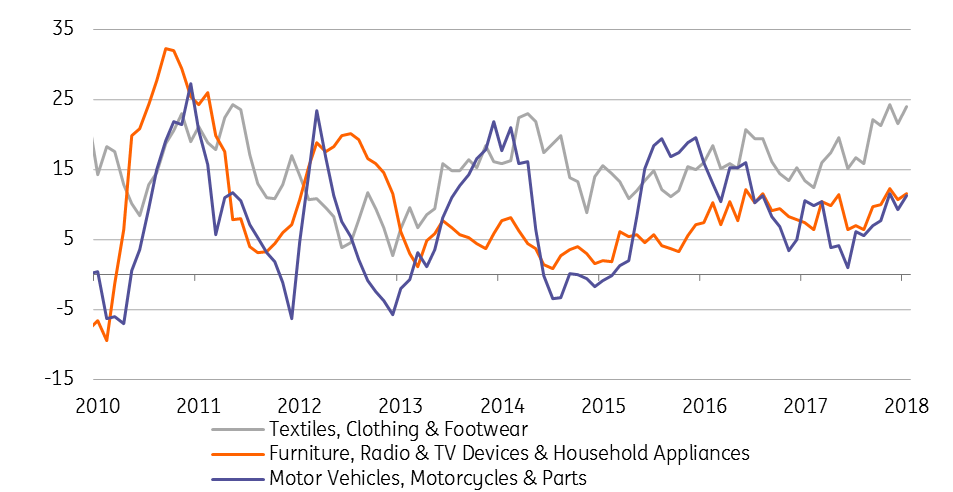

Retail sales accelerated from 6% YoY to 8.2% YoY. Car sales scored double-digit growth (12.5%YoY vs -3.1%YoY in December). Also, consumption of core goods (excluding fuels and cars) remained sound at 8.6%YoY (vs 7.6%YoY in December). Figures highlight solid private consumption (especially of durable goods) in 1Q18.

Retail sales in selected categories (%YoY, 3-Ma)

All in all today's data remains consistent with GDP growth close to 5% YoY also in 1Q18 vs (5.1%YoY in 4Q17).

We expect a limited reaction from the MPC on this strong activity data as the risk of overshooting inflation target is lowered compared to the previous quarter (core inflation is surprising to the downside).

In our opinion, the National Bank of Poland governor Glapiński is likely to keep forward guidance unchanged rates in 2018. We expect a rate hike in 1H19.