Poland: Industrial production sees upside surprise

Industry continues its upward trend. In December, production grew by 11.2% vs 5.4% in November and the consensus estimate of 8.3% year-on-year. The seasonally-adjusted growth rate was 0.5% vs 1.2% MoM in November. The export division saw the largest increase. The data shows a strong rebound in consumer demand for goods and investment demand looks good

| 11.2% |

Industrial production in DecemberCompared to consensus at 8.3% YoY |

| Higher than expected | |

Industry has continued to recover after hitting bottom in the second quarter of last year. This is supported by continuing demand from Asia, a relatively good situation in Germany's industry and a shift in demand from inaccessible services to durable goods. In December, the low base of December 2019 and favourable working days also played a role.

The highest growth was recorded in exports, such as computers, electronic and optical products, electrical equipment, rubber and plastic products, wood products, and furniture. The production of electrical equipment, which includes batteries for electric vehicles, alone contributed ca. 2.5ppt to the annual growth of production in December.

The data shows a strong rebound in consumer demand for durable goods, where growth accelerated to 30.2% YoY from 7.7% in November. Investment demand also looks strong, production of capital goods grew in December by 9.8% vs 7.3% YoY a month before. This, after the good construction data, is another indicator of improving investment demand.

We have already received the most important monthly data for December. All of the figures came as a positive surprise. The labour market remains strong, construction is recovering and industrial production continues to grow. Although retail sales have been negative recently, the declines were lower than expected, and consumer spending growth seems to be limited by administrative barriers rather than household budget constraints.

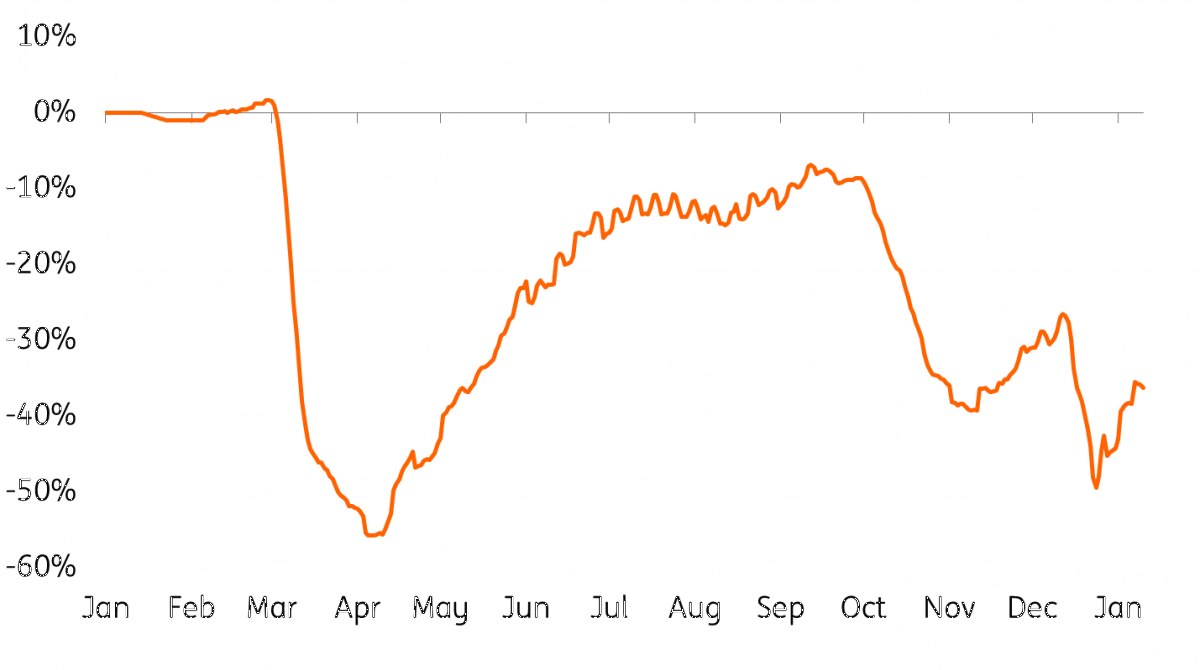

Restriction index

Our measure aggregating data on population mobility and information on the scale of administrative constraints.

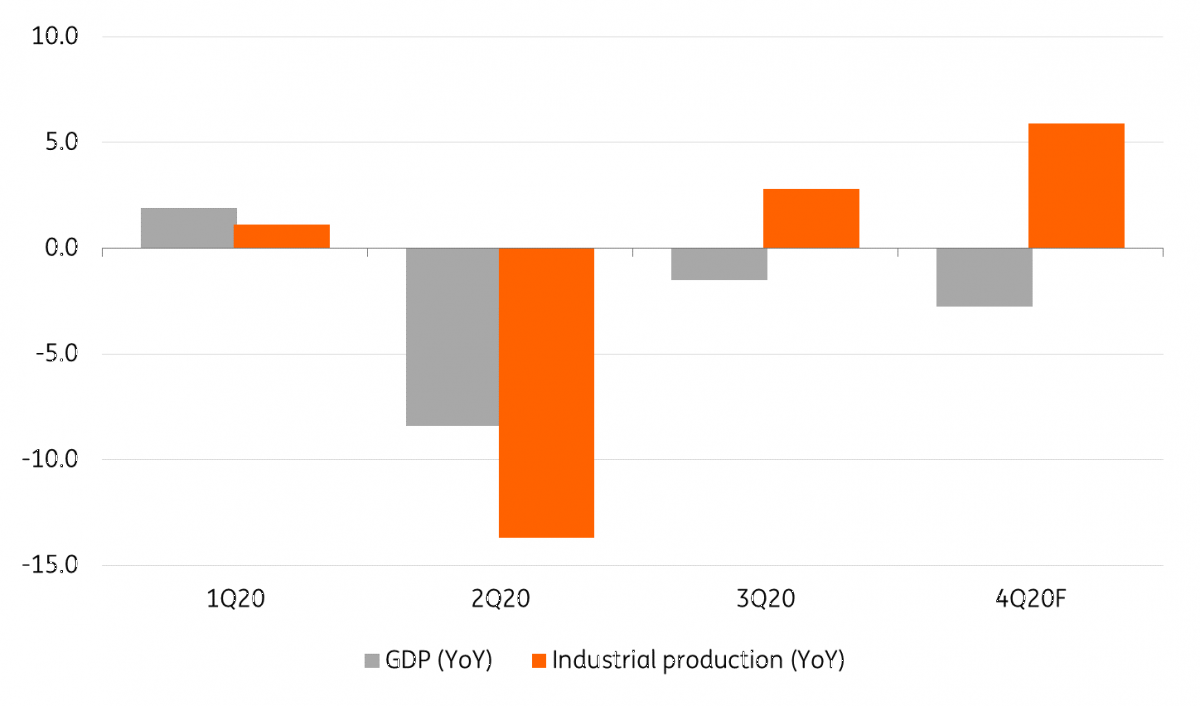

The new Covid cases in the fourth quarter in Poland were several times higher than in the spring, but our restriction index indicates that the administrative constraints were one quarter to a half less onerous than in the spring. In addition, the economy is becoming more resilient to further restrictions. We estimate that in 4Q20, the quarter-on-quarter drop in GDP was only about one tenth of what it was in 2Q20. We forecast that GDP in 4Q20 declined by ca. 2.5-2.8% YoY, and by 2.8% for the whole of 2020. Despite the negative figure, this would be almost twice as good as the expectations formulated in the spring.

GDP vs Industrial production in Poland

Download

Download snap