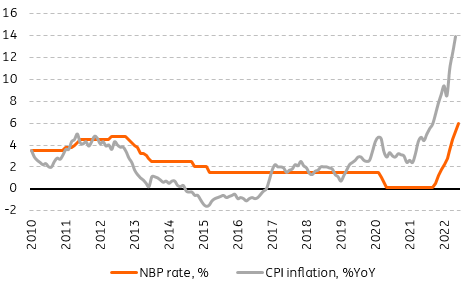

Poland’s central bank raises rates by another 75 basis points

The National Bank of Poland has hiked rates by another 75bp (ING: +100bp; consensus: +75bp) lifting the reference rate to 6%. It was the ninth rate hike of the current cycle which is likely to continue until we hit a target rate of 8.5%

Despite a further increase in inflation, the NBP's Monetary Policy Committee decided not to increase the scale of monetary tightening, which could have resulted from a marked deterioration in industrial sentiment (PMI in May fell below the 50-point threshold separating the recovery phase from the economic slowdown). Nevertheless, the cycle of rate increases remains aggressive. In the post-meeting press release, the Council admitted for the first time that price increases in Poland are being driven by continuing high demand, allowing companies to pass on cost increases to consumers. Policymakers are starting to recognise that domestic factors are also playing their part in elevated inflation.

In our view, one of the main reasons for significant interest rate increases is not only the high level of CPI inflation (according to flash estimates, it came to 13.9% YoY in May) but also increasingly clear signals of mounting secondary effects - rapidly rising core inflation - and a price-wage spiral (wage growth accelerated to 14.1%YoY in May). Concerns about the de-anchoring of inflation expectations are also intensifying. The increase in producer prices in April reached 23.3%YoY, so there is ample room for the mentioned pass-through of rising costs to final prices.

Inflation and the NBP rate

We estimate that the coming months will bring further increases in core inflation, with CPI reaching a local peak in the 15-20% range in the fourth quarter of the year. The macroeconomic environment remains conducive to sustained elevated inflation. Past increases in energy, transport, material and labour costs are spilling over into the final prices of an increasing number of goods and services. This is supported by still robust demand, driven by rising incomes due to the tight labour market and fiscal expansion. An important risk to inflation's path in 2023 is the scale of future increases in administered prices and decisions regarding the Anti-Inflation Shield.

Price growth as high as it is now is starting to become self-reinforcing. Containing it requires a decisive tightening of monetary policy, especially as the expansionary fiscal policy limits the restrictiveness of the policy mix. We expect further decisive moves from the MPC in the coming months and maintain our scenario of an increase in the reference rate in the current cycle to 8.5%. The next rate hike will come in July, when we will also learn about the latest NBP projections.

Download

Download snap