Poland: Another disappointment for the labour market

Both wages and employment surprised negatively in September. Weaker readings raise questions about whether salaries can grow 8% year-on-year in 4Q

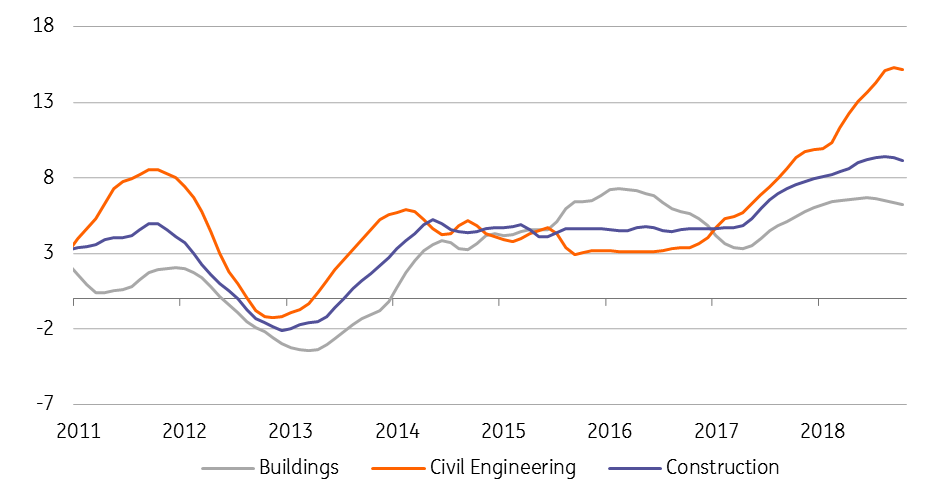

Wage growth decelerated slightly from 6.8% to 6.7% YoY, below the market consensus (7.1%) and in line with our call. The detailed structure will be available in the next two weeks. We expect the slowdown to be related to a weaker performance of retail trade, transportation and administration activities. All of those sectors posted rapid wage growth in the 4Q of 2017 and the first half of 2018 and are presently returning to a more normal level (see figure 1). Furthermore, lower profits of construction companies suggest weaker wage growth in this sector in the coming months.

Looking ahead we see limited scope for further acceleration in the final aggregate – the National Bank of Poland (NBP) survey pointed to a steady number of companies mulling over wage increases in both 2Q and 3Q. Given a slowdown of industrial activity in the eurozone and greater pessimism amongst surveyed industries in Poland, we expect a lower number of firms to report wage hike plans in 4Q.

We see increased downward risk to our call of wage growth at 8-8.5%YoY in 4Q. The readings for November and December should be boosted by bonus payments in the mining sector. Still, the overall trend points to a modest deceleration rather than an increase. In 1Q of 2019, the trajectory will be boosted by the regulatory rise of the minimum wage (7.1% vs. 5% in 2018), which should add 0.3 percentage points to the overall wage trajectory.

Enterprise employment decelerated from 3.4% to 3.2% YoY. The reason is twofold – the labour shortage creates supply-side barriers, while recent surveys show a lower willingness to increase employment among companies (visible in the vacancies data). Still, the number of workers laid off due to problems with their employers is still is in a downward trend (despite an increase in the bankruptcy rate reported by the likes of credit insurer Coface), which suggests a benign moderation of activity in the next few quarters rather than a sharp slowdown.

Fig1: Wage dynamics in selected sectors (%YoY)

Data transformerd with TRAMO/SEATS algorithm.

Fig2: Upward trend in construction sector wages likely to end in the coming months.

Download

Download snap