Korean production for September - Weak

Production in Korea fell 2.5% from the previous month to land 8.4% lower than a year ago. Expectations weren't strong, but this is a particularly weak reading. Any remaining BoK hawks must surely change their views.

More than just volatility

Month on month production growth in Korea is a volatile series, with all sorts of seasonal aberrations to contend with, so at first glance, the 2.5%MoM decline in industrial output (most of it from a 2.1% decline in manufacturing) might be written off as statistical noise. But a lot of that noise disappears when you examine the year on year growth. At -8.9% in September, you have to go back to 2009 and the aftermath of the global financial crisis to find weaker production data. This is no aberration.

The weakness wasn't confined to industrial production either. Construction activity also dropped for a second consecutive month and is running at -16.6%YoY. Even public administration (government) which you might have expected to be bucking this trend thanks to increased hires in the public sector, registered both a month on month and a year on year decline. In short, the Korean economy looks in bad shape currently.

| -8.4% |

Korean September industrial ProductionYoY% |

| Worse than expected | |

An inventory cycle is part of the explanation

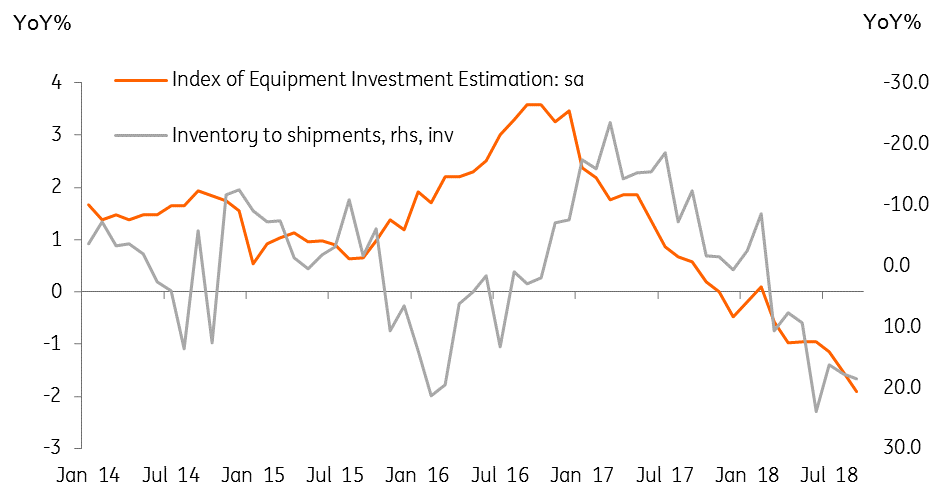

An old-fashioned inventory cycle is at least part of the explanation for the current weakness. Manufacturing production plotted against inventory to shipment ratios (inverted) shows that inventory ratios have risen sharply, requiring production to be cut back sharply in the near term. The same negative relationship holds for inventory ratios and equipment investment, shown below.

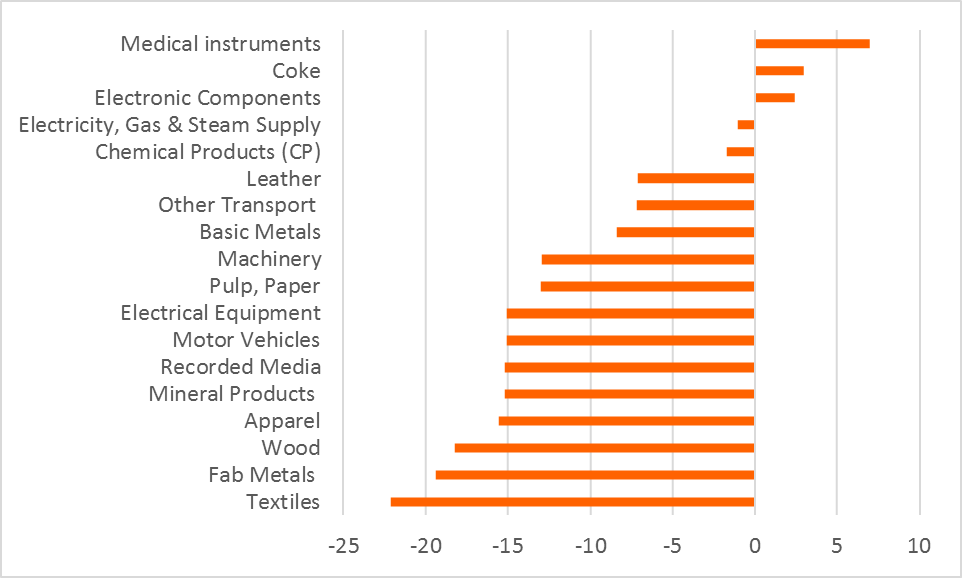

What isn't explained is why demand for the output is so slack that these inventories have risen so much. Looking at the components of production, it is actually a whole batch of old-economy products that are looking particularly weak. ELectronics isn't growing strongly, but it at least registers a positive sign for growth.

Korean inventory shipments ratio and equipment investment

Is this a trade war effect?

If this were a spillover from the trade war between the US and China, you would expect the production weakness to be mirrored in weakness of Korean exports to Asia. It isn't. Export growth to China is about 7.66%YoY. Where growth is particularly weak is to SE Asia (Singapore, Philippines, Thailand, Vietnam, Malaysia bucks the trend), and some of the frontier economies, Bangladesh, Pakistan. Exports to Taiwan are extremely robust. So it looks hard to pin this weakness on the trade war, or on some electronics-based product cycle. in short, this is puzzling, but nonetheless worrying.

Korean production by type YoY%

Market response

Markets are responding appropriately to this economic weakness. Korean 2Y bond yields are now down to 1.877%, from a little over 2.0% earlier this month, as any thoughts of BoK tightening in November are swept away by bad data. The KRW is also looking weaker. We expect it to reach 1145 before the end of the year. We will also be revising down our GDP forecasts for Korea in the light of this weakness.

Download

Download snap

31 October 2018

Good MornING Asia - 31 October 2018 This bundle contains {bundle_entries}{/bundle_entries} articles