Korea: Inflation rose in October, but has clearly passed the peak

Headline inflation picked up again in October due mainly to increases in the price of city gas and electricity, but stayed below the recent peak. Despite upside risk factors such as the weak KRW and rebounding food prices, we expect inflation to decelerate from now on, though we still think that the Bank of Korea (BoK) will raise rates 25bp in November

| 5.7% |

CPI inflation%YoY |

| As expected | |

Headline inflation is expected to decline from now on, but core inflation has more room to rise

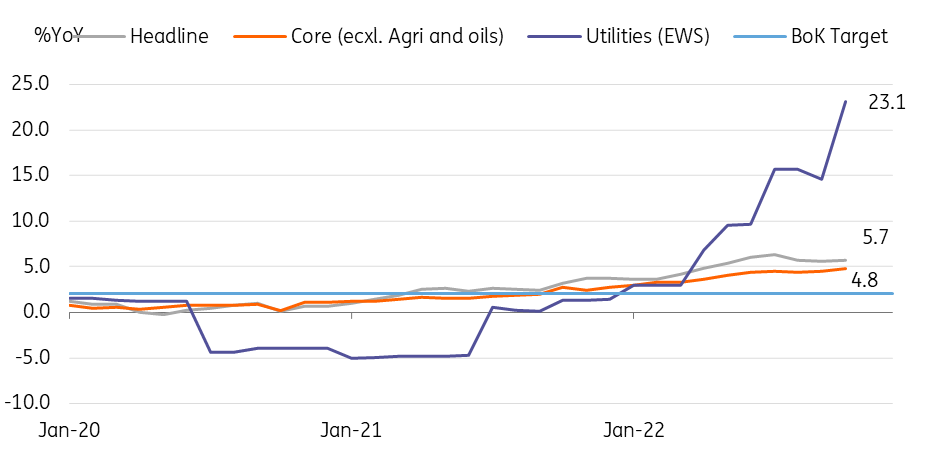

Consumer price inflation rose 5.7% YoY in October (vs 5.6% in September), in line with the market consensus. As city gas and electricity rates began to rise from October, utility prices (power, gas, and water) jumped 23.1%. This also pushed up core inflation excluding agricultural and oil products to 4.8% (vs 4.5% in September).

We believe that headline inflation will decelerate from now on. Ahead of the winter kimchi-making season in November, fresh vegetable prices, including cabagge (-31.2% MoM nsa), declined sharply (-13.1% MoM nsa) with better harvests than expected. Gasoline prices are expected to stabilize a bit more by the end of the year. Rent prices have stayed on the rise so far but market-observed rent prices began to drop from mid-year, which will soon be reflected in the CPI.

To be clear, there are still several upside risks to inflation in the near future. First, utility prices are expected to rise again next year as utility service providers respond to their operating deficits. And the recent credit crunch will also make it harder for such firms to issue additional corporate bonds in the near future. Second, global commodity prices have rebounded recently as unstable supply conditions have continued. And lastly, the weak KRW is likely to broaden inflationary pressure on other goods prices.

Considering both down and upside factors, we expect headline inflation will decelerate but will remain above 5% until early next year. If our current projections are right, then we will see inflation at around 4% in February next year, followed by a more rapid deceleration until the end of next year.

Inflation rose in October mainly due to higher utility prices

Market observed rental prices declined since May

The BoK outlook

The Bank of Korea will hold its last policy-rate decision meeting of the year on 24 November. And although inflation rose again in October, we think the BoK will pay more attention to the fact that inflation is down from its peak. The BoK will continue to hint at further tightening and inflation risks in its forward guidance. But, as the signs of a recession are becoming more evident - weak activity data, declining housing prices, and volatile financial market conditions - we believe that the BoK will slow the pace of additional rate hikes. Thus, we maintain our view that the BoK will return to its more usual 25bp hike pace in November.

Download

Download snap