Japan: Inflation may have peaked in January

Inflation has cooled sharply in Japan, mainly due to the government's energy subsidy programme. The labour market has tightened further led by the service industry. Meanwhile, the central bank's new governor Kazuo Ueda won't rush to exit easing monetary policy

| 3.4% |

Tokyo CPI inflation%YoY |

| Higher than expected | |

| 2.4% |

Jobless rate |

| Lower than expected | |

Tokyo inflation dropped sharply in February

Tokyo inflation dropped to 3.4% year-on-year in February from 4.4% in January, mostly due to the government subsidy programme which discounted energy fees. Energy prices rose 5.3% in February, much slower than the 26.0% rise in January. Looking ahead, inflation is expected to decelerate further in March due to the high base last year. This downward trend of inflation will buy time for new Bank of Japan governor Kazuo Ueda to not have to make any urgent policy changes.

Labour market conditions tightened further in February

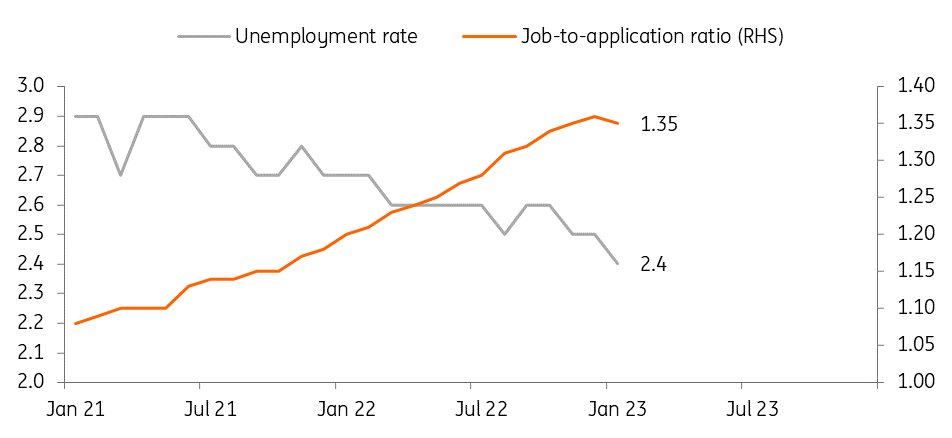

The unemployment rate stood at 2.4% in January (vs 2.5% in December), the lowest since the pre-pandemic level in February 2020. The jobs-to-applications ratio fell to 1.35 (vs 1.36 in December), marking the first decline since August 2020. We believe that the employment situation is improving, especially in the service industry such as accommodation and restaurant services, thanks to the recovery of tourism demand due to the government's travel voucher – essentially a gift card given to Japanese residents to use on domestic travel – and the return of foreign tourists. But, manufacturing jobs will likely decline as exports are expected to be sluggish for a while.

Also, although some companies face labour shortages, they are reluctant to hire for new positions because their margins have been squeezed with higher input costs. If inflation continues to slow, then it could have a positive impact on future hiring. If this happens, the sustainable inflation that the Bank of Japan has been hoping for may be achievable.

Labour market continues to improve

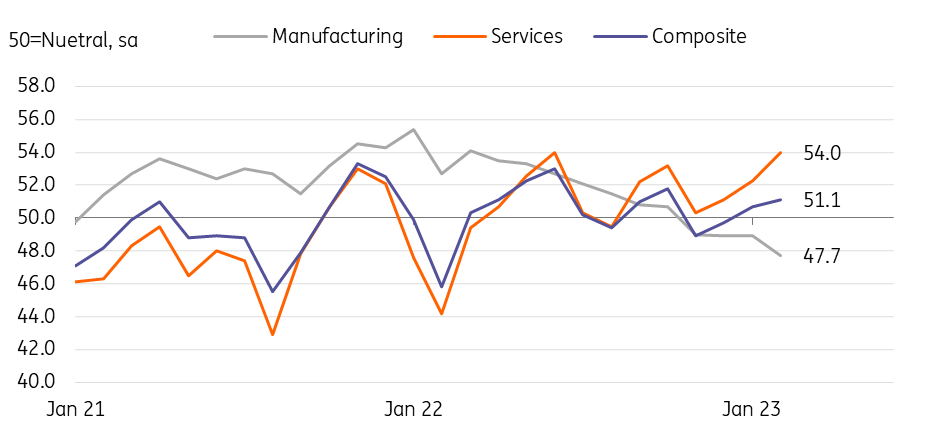

Service PMI rose more than expected to 54 in February

Service PMI continued to expand in February, staying above the neutral 50 level for a sixth consecutive month. New orders and overseas demand grew on the back of the receding impact of Covid-19 and increasing demand in the hospitality and travel industries. The employment index has also returned above 50, which is reflected in today's solid labour market report. However, manufacturing PMI declined to 47.7 in February (vs 48.9 in January), partially offsetting the gains in services. We believe that the service-led recovery will continue in the current quarter while manufacturing is expected to remain sluggish for the time being.

Service PMI rose in March

Bank of Japan (BoJ) watch

After carefully reviewing Ueda’s remarks at the two-day parliamentary hearing, we have updated our BoJ forecast. First, we think that the possibility of policy review under the new governorship has decreased as he has repeatedly emphasised that he is not pursuing the need to revise the joint statement with the government in 2013. However, we still believe that the possibility of delaying the request for review until after next year should remain open, as the revision can provide the BoJ with more flexibility to carry out its policy instruments.

Meanwhile, he stressed that it is appropriate to continue with monetary easing thus we think he won’t rush to make policy adjustments at his inaugural meeting in April, but will take the first step towards normalisation as early as June. By June, he will know the results of the spring salary negotiations and have enough time to monitor the impact of the December policy adjustment. But, wage pick-up and improvement in the labour market should be strong enough to convince him to make his first move.

In that sense, today’s data delivered mixed signals for the inflation outlook. The improved labour report provides a positive signal for the labour market and sustainable inflation, but the quick drop in inflation shows that the higher-than-usual inflation is mostly driven by cost-push factors. Thus, for the coming months, the Bank of Japan will monitor how fast inflation slows and how tight labour conditions can support sustainable inflation and adjust its policy accordingly.

It's worth noting that the outgoing BoJ governor Haruhiko Kuroda is well known for delivering surprises to the market, so he may give up the yield curve control policy without leaving it to his successor. But, we still think that Kuroda will leave the decision to the new governor by standing pat at the upcoming March meeting.

Download

Download snap