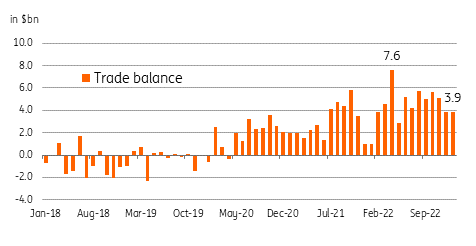

Indonesia’s trade balance beats estimates but still smallest since May

Indonesia’s January trade balance settled at $3.9bn after exports beat expectations

| $3.9bn |

January trade balancesmallest since May 2022 |

| Higher than expected | |

Exports rise 16.4% while imports up only modestly

Indonesia’s export sector managed to outpace expectations with overall outbound shipments rising 16.4% year-on-year compared to the 12.5% YoY expectation. Export gains were driven largely by robust oil & gas shipments although non-oil exports managed to expand by roughly 14% on robust exports to China (+49.4% YoY) and Japan (+24.9% YoY). Meanwhile, imports managed to eke out gains, up by only 1.3% YoY.

Import growth was driven mainly by imported energy as oil & gas imports were up sharply by 30.4% YoY. This managed to offset the contraction reported in non-oil and gas imports.

The overall trade balance settled at $3.9bn, the lowest since May but slightly better than expectations. We expect that trade surpluses this year will be robust but nowhere close to the record high of $7.5bn in April of last year. Thus, we can assume that the Indonesian rupiah will see less and less support from the current account in 2023.

Trade surpluses just not what they used to be...

Exporters forced to keep earnings onshore?

Today’s trade report comes on the heels of reports that Indonesia will soon be requiring certain exporters to keep a portion of export earnings onshore in a bid to help boost the domestic supply of foreign currency. And although details and timelines on the potential implementation of the measure have yet to be released, we are unsure if this would provide meaningful support to the IDR. Uncertainty regarding the measure and the possibility of this regulation being pulled abruptly may result in episodes of volatility for the currency, especially if some market participants view this as a form of capital control.

The IDR may be facing diminished support from the trade and current account surpluses this year but the currency could be steadied by renewed foreign investor flows should sentiment towards emerging markets improve substantially in the coming months.