Hungary: The revival of the retail sector

After a year of decelerating growth in retail sales, the sector seems to be reviving in 2019. Is it a new trend or just a blip?

| 8.4% |

Retail sales (YoY)Consensus (5.4%) / Previous (5.4%) |

| Better than expected | |

Hungary's ebruary retail sales data significantly overperformed expectations as it reached an 8.4% YoY growth rate, the highest since Jan 2018. The strong figure is really surprising as the sales volume growth showed a decelerating trend last year without giving any clues a turnaround was coming. Instead, it seems the sector regained some positive momentum in the beginning of the year. The main driver of the increase could be the still double-digit (and higher-than-expected) wage growth, and maybe strengthening inflation is urging households to spend as the their savings in cash sum up to a record high of 11.4% of GDP.

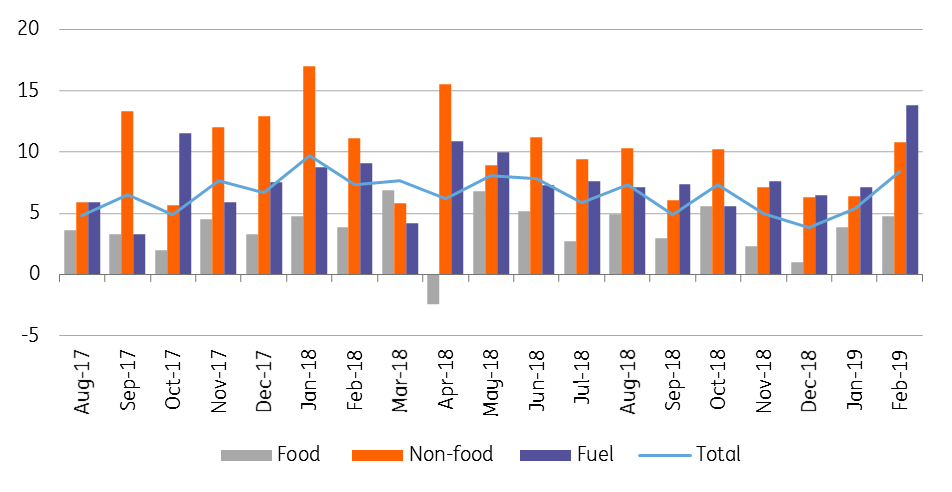

The contribution of all types of shops increased in February. The turnover in food shops grew by 4.8% YoY, while the non-food shops' growth rate reached 10.8% YoY, both jumping to multi-month highs. The sales volume of fuel shops posted a five-year high year-on-year growth of 13.8%, responsible for the majority of the surprisingly strong retail performance. This strong reading has a lot to do with a drop in fuel prices in February, so we see this effect as rather a temporary one.

Breakdown of retail sales (% YoY)

Working-day adjusted

Against this backdrop, we expect the retail sales to increase by 4-5% on average in 2019, as the sector’s flying start is rather tied to favourable fuel prices in the first couple of months of this year. As fuel prices increased a lot in March and are expected to increase further in April, we see some slowdown going forward. The biggest question mark remains how households will react to strengthening inflation, which poses an upside risk to our forecast as buyers could start to frontload spending due to the elevated inflation expectations. It would pose a double-barrelled risk as the higher demand would translate into higher inflation again, moreover it can speed up the deterioration of the current account balance.