Difficult to see the Hungarian labour market trends clearly

Despite easing containment measures from April onwards in Hungary, the unemployment rate increased, reflecting late labour market feedback from the third wave of Covid-19

| 4.4% |

Unemployment rate (April)ING forecast 4.2% / Previous 4.0% |

| Worse than expected | |

Recently, the market had become used to upside surprises regarding the Hungarian economy, hence the widespread expectation of improving labour market statistics in April. We were an outlier, seeing the worsening trend based on past experiences of a delayed negative labour market impact.

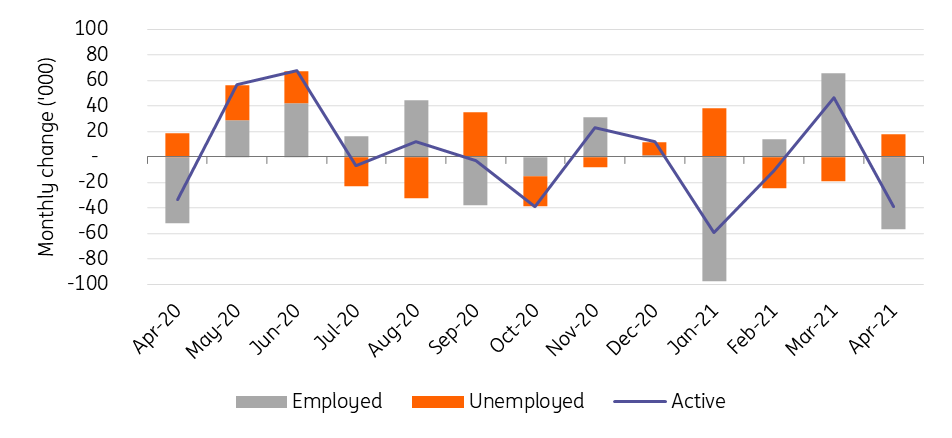

Even though the reopening started in April, statistics show the number of employed people decreasing and the number of unemployed increasing on a monthly basis. The unemployment rate came in 0.4 percentage points higher than a month ago, sitting at 4.4% in April. Employment decreased by more than 1.2% MoM. This suggests that the lay-offs triggered by the third wave of Covid-19 and the related containment measures appear with a lag in the labour market metrics.

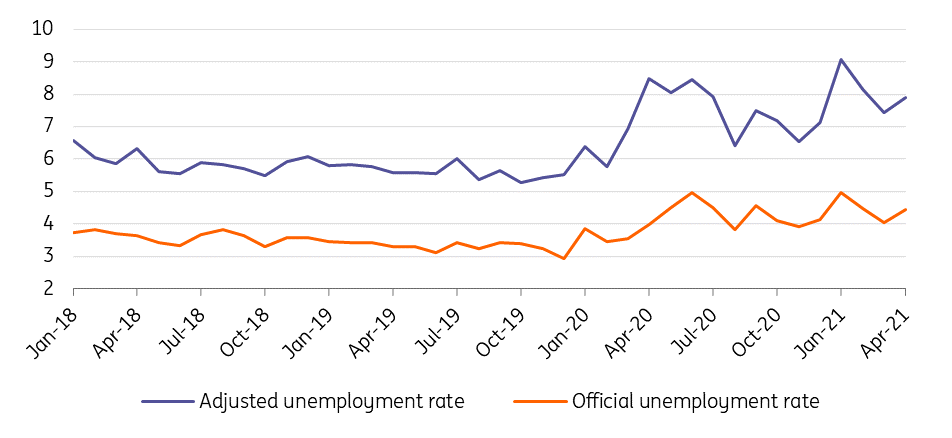

Labour market trends (%)

The impact on the unemployment rate could have been worse, but due to statistical-methodological issues, the majority of people who lost their jobs ended up in the group of inactive labour force, reducing the participation rate in the Hungarian labour market.

Changes in activity, employment and unemployment

In addition, the underemployed and part of the inactive labour force count as the potential labour reserve.

Due to methodology issues, the potential labour reserve will probably better explain the recent labour market situation. Workers who were inactive and want to work but not looking for a job or looking for work but unable to start work within two weeks are part of the potential reserve.

These groups added to unemployment leads to an adjusted unemployment rate, which is – according to our estimates – sitting close but below 8%, in contrast with the official 4.4% reading.

The official and adjusted unemployment rates (%)

Going forward, real changes in the labour market will be measured better by this adjusted reading, as we will see a lot of “inactive” people taking a job right away as reopening ripples through the labour market, which means that both participation and employment will increase, and won’t impact the official unemployment rate much.

In contrast, the potential labour reserve will shrink significantly, showing the real impact of the reopening, suggesting continuous support to the rebound in economic activity.