Hungary: Inflation jumps above target

Hungarian headline CPI is back above the 3% target for the first time since January 2013 and is set to remain there for the next couple of months. The central bank, however, will remain silent

| 3.1% |

Headline inflation (YoY)Consensus (3.1%) / Previous (2.8%) |

| As expected | |

Headline inflation came in at 3.1% YoY in June, posting a 0.3ppt acceleration compared to the previous month. This is the first time since Jan-13, that headline inflation overshot the NBH’s 3% inflation target. Core inflation remains flat at 2.4% YoY. Against this backdrop, the recent uptick is still mainly due to factors outside the core inflation basket, therefore it won’t trigger any reaction from the central bank.

Remember the NBH sees headline inflation around 3.2 to 3.4% YoY until September and recent data came in a little lower (the NBH June forecast was 3.3% YoY), and the stability of core inflation backs up the central bank's view that it's confident loose monetary policy can achieve its inflation target in a sustainable manner, hence why no one should expect any particular moves here.

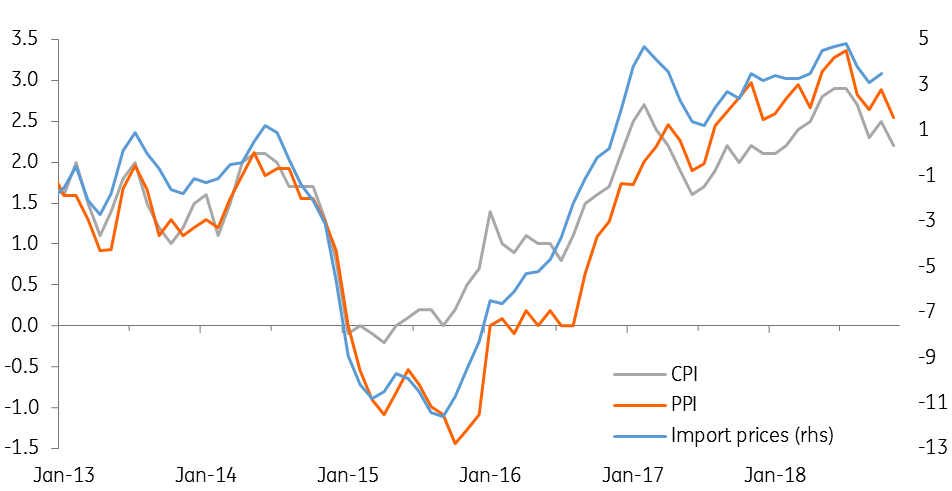

Headline and core inflation measures (% YoY)

In line with expectations, the main trigger behind the uptick in the headline indicator was the 15% YoY increase in fuel prices. In practice, this alone pushes the CPI up by 0.4ppt compared to May. Looking at food, alcoholic beverages and tobacco prices, we see a mild deceleration, but inflation pressure in these product categories has remained above average. The main reason behind the flat core inflation is the price movements in durables, where the statistical office registered another 1.1% YoY drop. Inflation in services also remained below the average, showing a slight deceleration to 1.6% YoY.

We think inflation will remain above the inflation target in the next couple of months – in line with NBH’s forecast – but as long as we won’t see a strengthening in core inflation, we hardly see a change in the NBH’s monetary policy stance. The classic ‘chicken game’ between the market and the NBH whether who is right when it comes to inflation pressure continues.

CPI by main groups in June