Hungary: Inflation data is mixed bag

Headline CPI has remained unchanged at 3.4%. This beat estimates largely because of an unusual jump in food prices in August. As a one-off though, don't expect the National Bank of Hungary to react

| 3.4% |

Headline CPI (YoY)Consensus (3.3%) / Previous (3.4%) |

| Higher than expected | |

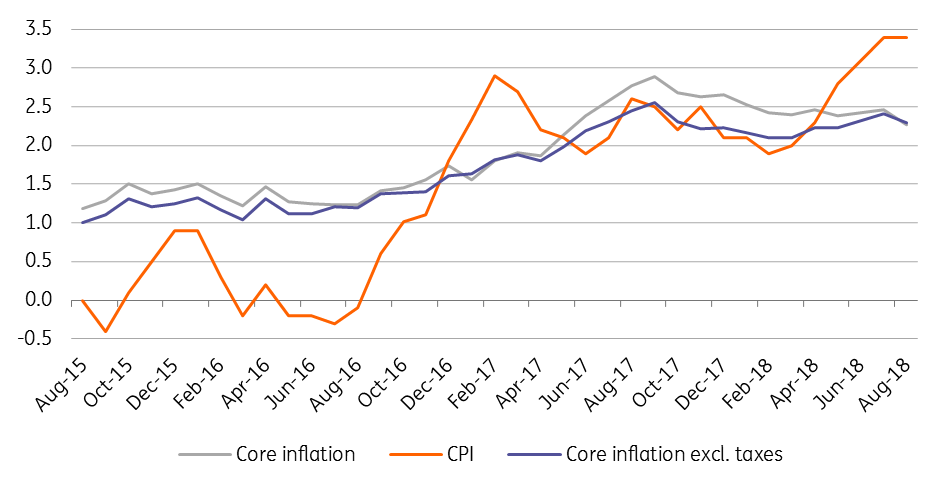

Headline inflation came in at 3.4% year-on-year in August, showing no change from July. The surprise in this reading wasn’t that headline inflation has remained above the 3% target for a third month but the fact that it did not show any softening. Despite the headline reading overshooting the NBH's 3.3% forecast, we don’t see this as a game changer, as core inflation surprised on the downside. The 2.2% YoY reading here was a 16-month low, showing that the recent upside surprise in inflation came from one-off factors, which will be ignored by the monetary authority.

Headline and core inflation measures (% YoY)

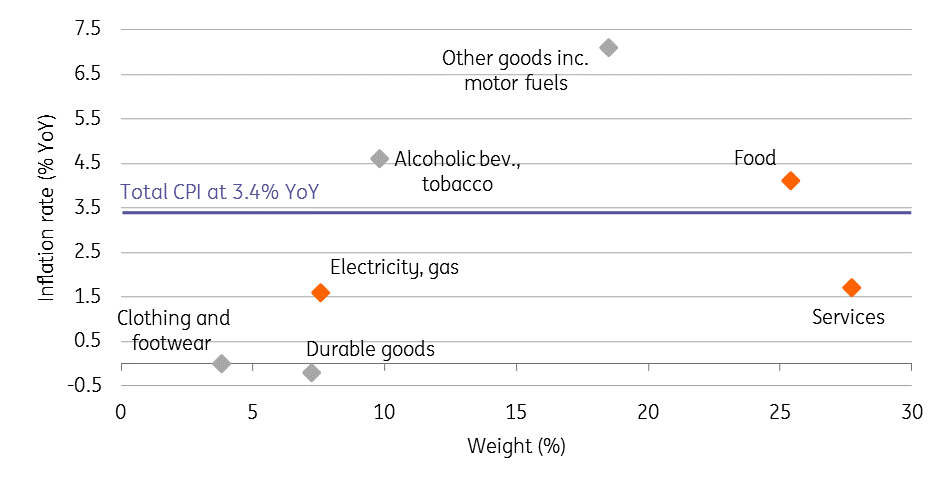

As we previously expected, the main driver in August's headline CPI was the 16.3% YoY growth in fuel prices, showing a mild deceleration from the previous month. In addition, food prices increased by 4.1% mainly in fruit and vegetables- an unusual pattern. We haven’t witnessed the usual seasonal drop, mainly because of weather issues affecting the harvest.

CPI by main groups in August 2018

The year-on-year price change in durables came in at -0.2% YoY, an important factor behind the deceleration in core inflation. Regarding services, inflationary pressure is still not worrying at all, as services inflation came in at 1.7% YoY, only a mild increase compared to the previous month's data.

For the rest of the year, we expect inflation to remain between 3.1-3.4% YoY. Despite the base effect of oil prices dragging down the headline rate, the recent changes in tobacco excise duty and the upswing in food prices will keep inflation rates elevated. In any event, we don't see the NBH changing its inflation forecast materially at next week’s meeting.