Hungary: Industry shows growth, the last for a while

Industrial production rose amid supply chain disruptions in February, but March is expected to be affected by local shutdowns

| 1.7% |

Industrial production (YoY, swda)Consensus 0.6% / Previous 2.8% |

| Better than expected | |

After starting 2020 on a positive note, industry continued to surprise in February. The 1.7% year-on-year (seasonally and working-day adjusted) growth rate can be seen as a strong reading in such a global environment. Despite the official statistical release claims that Covid-19 did not affect the data, this is not necessarily true. In February, we saw supply chain disruptions mounting as China and other Asian countries saw a peak in the disease while some European countries started lockdowns later in the month. So, in a way, this industrial performance shows some resilience in the early phase of the pandemic.

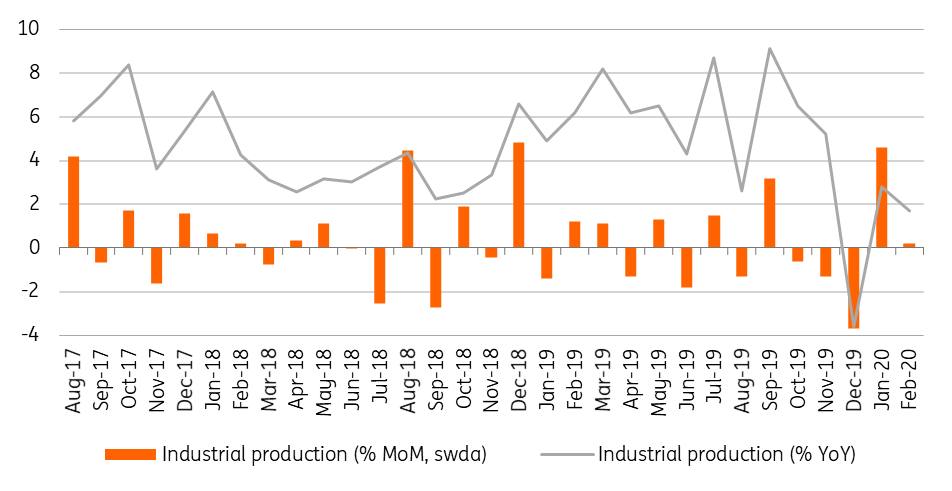

Performance of Hungarian industry

The commentary released by the Hungarian Central Statistical Office also helps clarify the good performance. The electronics and food sectors were able to ramp up production. The latter makes sense as the sector increased capacity utilisation to prepare for the run on food. Supply chain disruptions are less severe in electronics as storage capacity is better than, for example, in car manufacturing. Speaking of which, car makers saw production decelerate, while other industries saw a drop in production.

Manufacturing PMI and industrial production trends

Looking forward to March, we expect a widespread fall in industrial output as some of the more significant sectors join the smaller ones in facing disruption. Car makers and related local suppliers closed for business in mid-March. Pharma and food sectors will support the overall performance in industry, but this won't be enough to stop production from nosediving. A huge drop in March is also supported by the recent PMI data, and the trend is pointing downward. However, due to a strong first two months of the year, on a quarterly basis we might see only a stagnation in industry. This would support our call that the nadir is coming in the second quarter, while the first quarter will provide relatively strong GDP data.

Download

Download snap