Hungary: Industry pushes the limits

A decent start to the year in industry has continued, with growth actually accelerating in March. This strongly supports 1Q GDP growth, though negative risks remain

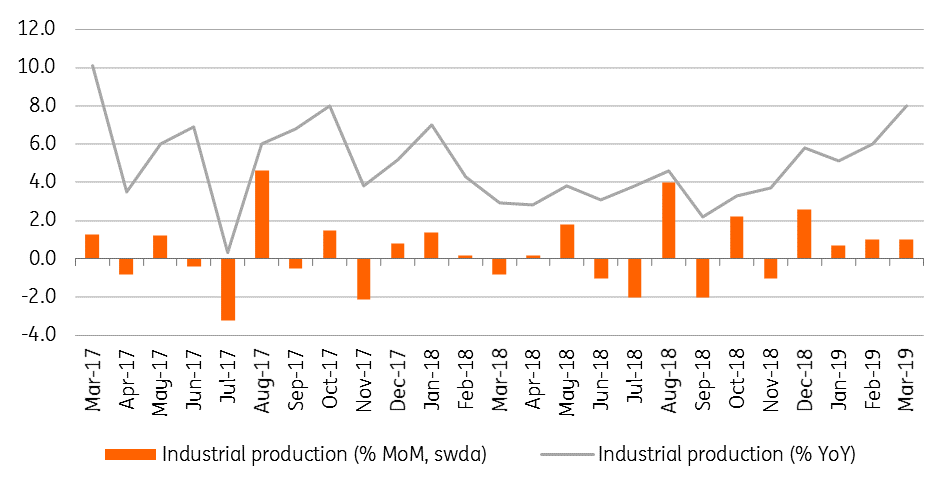

Industrial production not only maintained the great momentum seen at the beginning of the year but actually accelerated in March. Seasonally-adjusted output increased by 8% year-on-year- the highest rate since October 2017. What's more, the monthly growth rate has now been positive for four consecutive months, something which hasn't been seen in years. On average, industrial production grew 6.2% YoY in the first quarter, despite the negative effects of a gloomy external environment. Overall, this paints a really positive picture and supports further optimism ahead of next week’s GDP data.

Performance of Hungarian industry

The greatest contributor to the IP data, the car industry, accelerated in March and boosted the overall performance. Indeed, most industries had a positive contribution. Heavily-weighted components like electronics and machinery posted a positive yet decelerating increase in output. New export capacity, being utilised throughout the year, could have a positive impact on the current account and GDP in the first quarter, as well as in the upcoming quarters.

Growth rate and volume of industrial production

Looking forward, we think this excellent performance can continue, partially on the back of strong domestic demand. However the risks are rather tilted to the downside. There are still uncertainties about the final outcome of Brexit and the trade war, which could hurt the industrial sector. The greatest threat remains the imposition of tariffs on imported cars in the US, which is still on the table. All things considered, we see a 6% average growth rate in 2019, with the balance of risks rather skewed to the downside.

Manufacturing PMI and industrial production trends

When it comes to the big picture, it seems that the economy is pushing the limit and there is no strong sign of a slowdown. Rebounding retail sales, record-breaking construction performance and strong industrial output could lead to a huge positive surprise in the 1Q19 GDP reading.

Download

Download snap