Hungary: February is a mixed bag in the job market

After a significant jump in January, the unemployment rate decreased in February but the details suggest that's because the participation rate in the labour market has decreased

In January, we saw the Hungarian unemployment rate jump to 5% and we expected even more deterioration but February numbers provided an upside surprise as the unemployment rate decreased by 0.5 percentage point on a monthly basis to 4.5%.

Compared to a year ago, the unemployment rate is still 1ppt higher, so a significant gap remains in the labour market compared to the pre-pandemic situation.

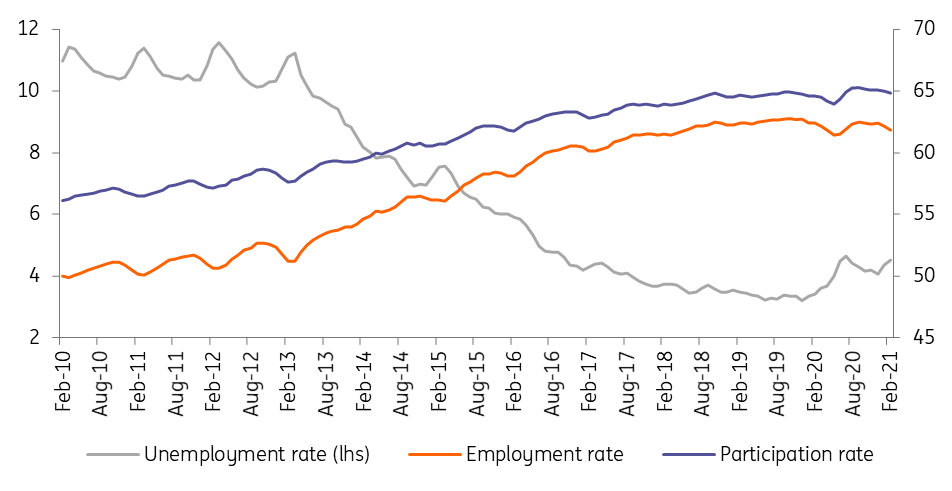

Labour market trends (%, 3-month moving average)

At face value, we could say that the labour market showed remarkable resilience after the second wave but National Employment Service data for February tells us a different story. The number of registered jobseekers increased by 1.2% month-on-month in February, moving to above 300,000.

The drop in the number of economically active people is the main source of the headline improvement of the unemployment rate

The details show that the number of employed people increased by 13.5k MoM, while the number of unemployed decreased by 25k. This means the Hungarian labour market lost 11,500 jobseekers who disappeared from the labour market. So, the drop in the number of economically active people (those who are either working or actively looking for a job) is the main source of the headline improvement of the unemployment rate.

Monthly changes in labour market metrics ('000)

Looking ahead, we expect more people to fall out of the active labour market as the government re-introduces strict curfew measures. With that, unemployed people with kid(s) won’t have much choice but to give up on the job-seeking process, artificially reducing the unemployment rate. On the other hand, this new round of mobility restrictions from March may also result in layoffs, so in all, the first quarter of 2021 will be quite a mixed bag.

In our view, all of these changes are pointing towards one thing: a negative impact on consumption and GDP growth in 1Q21.