Hungary: Budget worsens again on EU projects

The government has continued to pre-finance EU projects, causing a remarkable cash-flow based deficit. As for December, we see significant EU money inflows

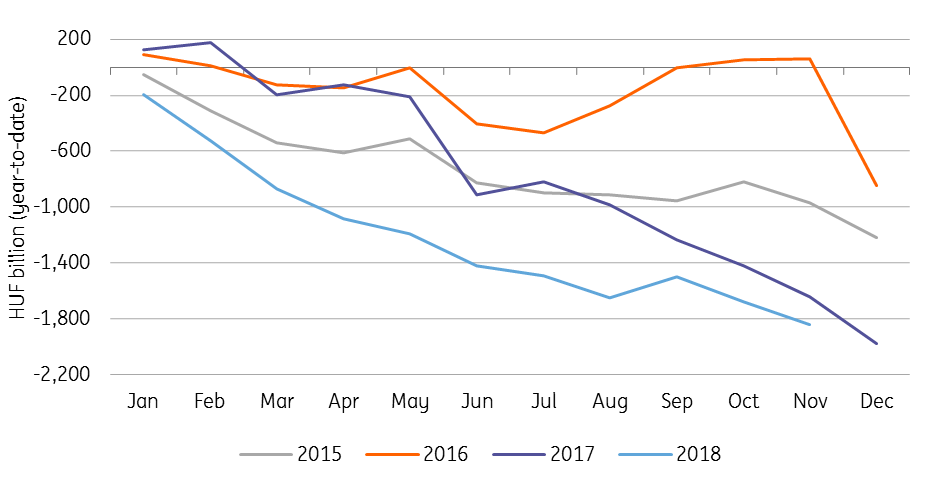

The cash-flow based deficit deteriorated further in November, at HUF1,842.4 billion. Considering the monthly change, the budget worsened by HUF164.4 billion. The latest figure exceeds the original cash flow-based target in 2018 by 35%.

Cash-flow based year to date deficit

The significant deterioration was mainly due to pre-financed EU projects and extra pension disbursements. Considering the 2.2% four-month rolling Maastricht-based deficit (including 4Q17–3Q18), which has already been below the 2.4% deficit-to-GDP target, and the favourable debt-to-GDP ratio for 3Q18, the government might decide to continue pre-financing EU projects at a faster pace yet again, as it won’t jeopardise the major budgetary indices.

According to the Ministry of Finance, the government has spent HUF1,737.4 billion on EU projects, while having only HUF574.6 billion of inflows in 2018 so far. Compared to the previous month, Brussels transferred roughly HUF100 billion to the government while the government pre-financed HUF156.4 billion worth of EU projects, resulting in a negative net effect. Regarding the so-called pension premium, outstanding economic expansion has made it possible to top up pensions, which explains a further HUF41.2 billion out of the monthly financing gap.

On the revenue side, we hardly see any change. Revenues outperformed last year’s figures mainly due to the significant increase from VAT, personal income and payroll taxes. As for the last month of 2018, we don’t expect the robust momentum to stop.

Bottom line is, the overall underlying budgetary situation is rosy. With HUF300-400 billion of inflows still expected to come from Brussels and the positive underlying trends likely to remain with us, there is a significant likelihood that the final deficit-to-GDP figure could be even lower than 2.0%.