Hungarian inflation continues to climb

The last time Hungary’s headline inflation was this high, the sci-fi movie Armageddon was in theatres. Quite fitting, given the peak of inflation is still ahead of us

| 13.7% |

Headline inflation (YoY)ING forecast 13.3% / Previous 11.7% |

| Higher than expected | |

Inflation strengthens further

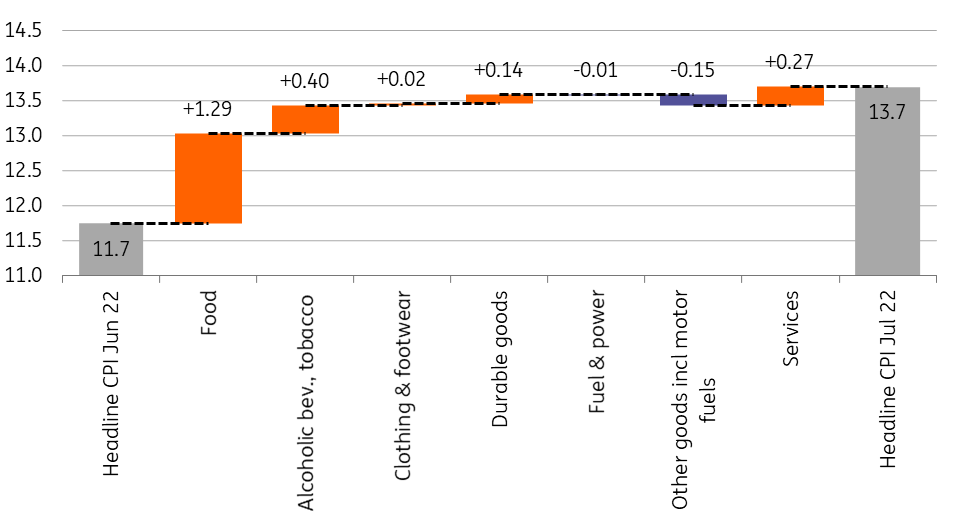

Hungarian inflation readings continue to surprise us. Headline inflation came in at 13.7% year-on-year in July after a 2ppt acceleration compared to June. The last time inflation was this high was July 1998 when the blockbuster film Armageddon was released. Besides the usual suspects, we have some new reasons for this acceleration in inflation and we can’t blame the base effect, considering the high 2.3% month-on-month inflation print.

Main drivers of the change in headline CPI (%)

The details

- Price changes in food have remained the main contributor to inflation and it is the most important accelerator behind the July move. Prices rose by 27% on a yearly basis. Some basic food items (e.g. margarine, bread, cheese, pasta) not affected by the price cap measures are showing annual inflation of 50-60%. Producers and retailers are keen to pass on the rising producer prices to consumers as energy, labour and transportation costs keep rising. But the latest fiscal measures are affecting prices as well. Regarding food, the most important effect came from the extension and increase of the public health product tax (a tax levied on food products containing unhealthy levels of sugar, salt and other ingredients).

- Speaking of fiscal measures, changes to the excise duty contributed to the double-digit price increase (11.2% YoY) in alcohol beverages and tobacco. Price changes in this product group explain 0.4ppt of the acceleration in July. However, tax changes alone aren't to blame, as forint weakness had an impact here as well.

- Forint depreciated significantly during July and probably pushed importers to pass on the related costs. The result is clearly visible in the 14% year-on-year inflation in durables, which is the highest print since the summer of 1996.

- After a base effect-driven drop in June, inflation in services accelerated again to 6.8% year-on-year. The main drivers here were passenger transport, home and vehicle repair and maintenance and holiday packages. The only source of downward pressure came from fuel prices whereas the combination of price caps and base effects translated into an artificial anti-inflationary impact.

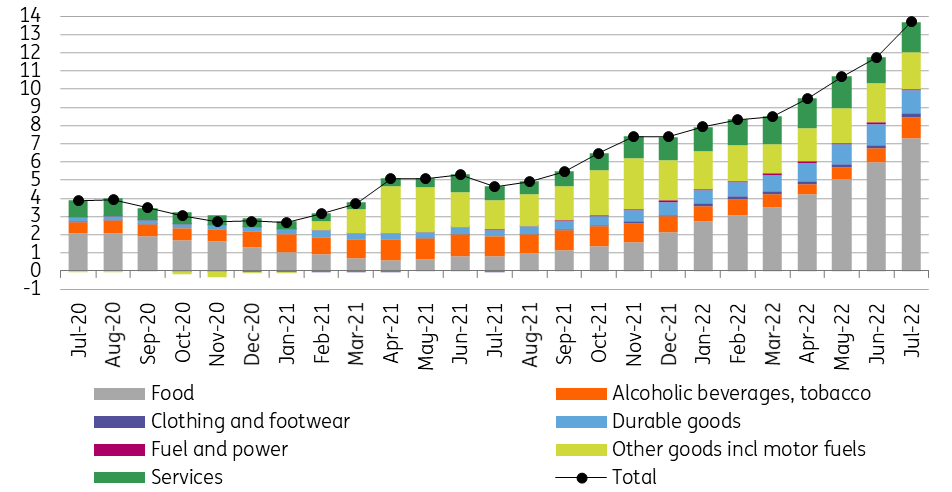

The composition of headline inflation (ppt)

Two-thirds of the consumer basket show double-digit inflation

With fuel inflation dragging down the headline reading, the rise in core inflation – which does not include fuel in its inflation basket – is hardly surprising. After a 2.9ppt increase, core inflation reached 16.7% year-on-year in July. Other factors suggest that high prices are becoming more entrenched. For example, sticky price inflation – a good predictor of medium-term developments in price changes – moved up to 13.4% YoY. Broad-based price pressures are also indicated by the fact that 66% of the items in the consumer basket have already shown a double-digit inflation figure in July.

Headline and underlying inflation measures (% YoY)

Changing our forecasts, again

Inflation in Hungary is expected to strengthen further in the coming months. Corporates will probably continue to pass on some of the burden coming from “windfall” taxes to consumers. The changes in the utility bill support scheme will also have a pro-inflationary impact. According to our calculations, the rising cost of electricity and gas will add an extra 2-3ppt to the inflation print from August. In addition, the latest geopolitical flare-up in Asia could have a further impact on input prices, while local labour shortages are also driving up labour costs. The only positive development is that EUR/HUF has fallen from its peak, but we hardly see this as a game-changer in the short run.

The extent and timing of the peak in price pressures highly depend on price caps as well, which are in place until 1 October. We see a gradual phase-out and with that we expect headline inflation to peak in the 17% YoY area in the fourth quarter. However, should the government scrap the price caps in one step, this could result in a close to 20% inflation print in October. On average, we forecast a 12.5-13.0% headline reading in 2022, with a 9.5-10.5% inflation range in 2023. Risks are still clearly tilted to the upside.

Hungarian central bank to continue its decisive hikes

As far as monetary policy is concerned, the situation remains delicate. Although a central bank typically should not react to tax increases and one-off non-core price shocks (such as changes in administered prices), this needs to be seen through a different lens in this inflationary environment. There is a major threat that inflation expectations will remain permanently high, strengthening wage-push inflation. To break such second-round effects, Hungary's central bank must respond to the recent rise in inflation. In our assessment, the National Bank of Hungary won't be able to back down from the decisive interest rate hike policy seen in the last two months. In the coming months, the central bank may need to continue hiking interest rates in 100bp steps. To achieve a positive real interest rate environment as soon as possible (permanently strengthening the forint), we might see the central bank reaching the terminal rate at around 14-15%. Of course, the central bank can replace part of the interest rate hikes with new measures and instruments that significantly reduce forint liquidity, thereby tightening monetary policy and improving monetary policy transmission.

Download

Download snap