Hungarian industry surprises on the upside

After two months of poor performance, Hungary's industrial production registered a surprise 3.8% month-on-month expansion. As always, car manufacturing did the heavy lifting

| 5.7% |

Industrial production (YoY, wda)Consensus -0.5% / Previous 0.9% |

| Better than expected | |

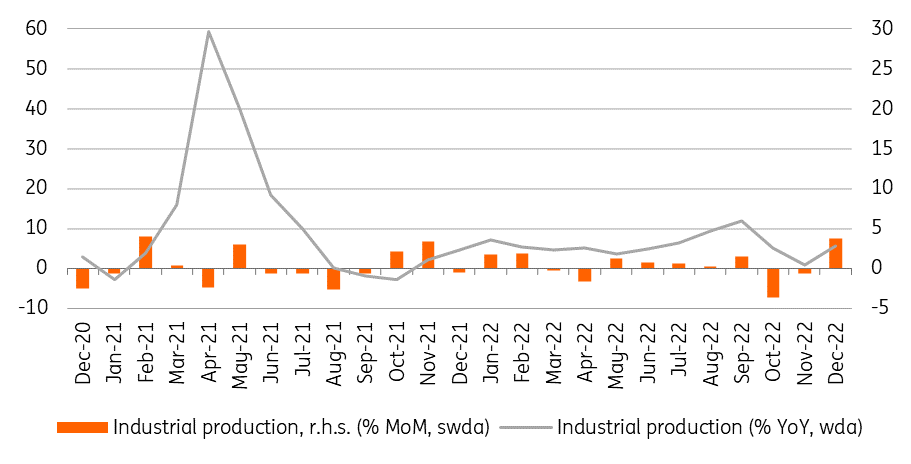

Traditionally, industrial production in December has performed worse than in the previous two months, but this was not true in 2022. According to the raw data, industrial production rose by 2.0% year-on-year (YoY), while the rate of growth came in at 5.7% after adjusting for calendar effects. The significant difference is due to the fact that there were two fewer working days in December 2022 than in 2021. The better-than-expected yearly-based expansion is the result of a surprisingly good 3.8% increase in industrial production from November to December. In fact, growth in December was so strong that industry was essentially able to make up for the contraction it had accumulated over the previous two months and production levels returned to near September levels.

Performance of Hungarian industry

We have to wait another week for the Hungarian Central Statistical Office (HCSO) to release the detailed subsector data but judging by the short commentary posted by it, the performance continues to be a tale of two halves. According to the preliminary statement, the largest positive contributors to industrial performance were car- and electrical equipment manufacturing, which both expanded on an annual basis.

In contrast, other sectors, such as the dominant food industry and electronics manufacturing posted year-on-year contractions in the volume of production. Against this backdrop, the overall positive industrial performance is due to strengthening car manufacturing and related supply sectors, like electric vehicle battery production.

Volume of industrial production

After three consecutive PMI readings of 55+ (63 in December) and two consecutive drops (October and November) in the volume of industrial production on a monthly basis, it seems like the forecasting ability of this soft indicator is deteriorating. In our view, PMI readings alone are not able to predict the future trajectory of industrial performance, but when combined with other types of soft indicators the outcome is much clearer.

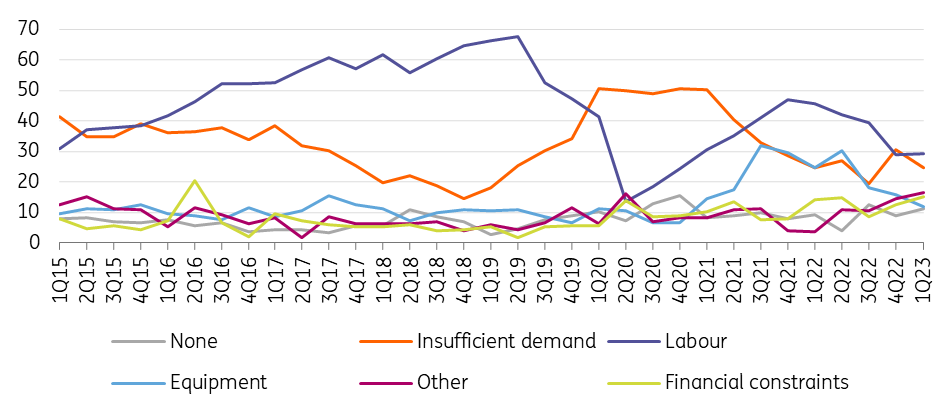

Factors limiting production in Hungarian industry (% of respondents)

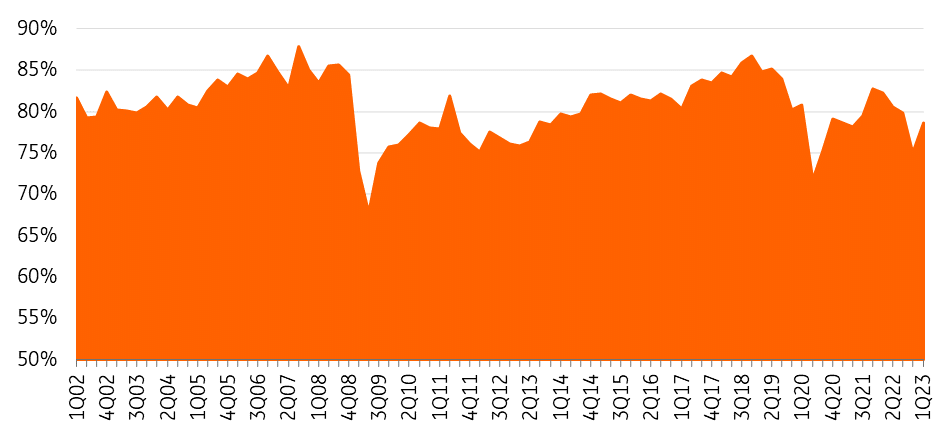

In this regard, the latest quarterly survey results on factors limiting production, along with the current level of capacity utilisation data, further clarifies the direction of Hungary's industry. Eurostat data shows that capacity utilisation has improved since the last survey was conducted, signalling almost 79% utilisation in the first quarter of 2023, although this is still below last year’s average. On the other hand, labour-related issues eclipsed insufficient demand as the number one factor that is limiting production, according to the survey. Such an outcome comes as no surprise given the already well-known tightness of the Hungarian labour market. The improvement in equipment and demand-related concerns, along with growing capacity utilisation are in line with the trend in PMI data, which has been expanding since October 2022.

Current level of capacity utilisation (%)

Even though December’s surprisingly good industrial performance somewhat counterbalanced the declines registered in the previous two months, we believe that the overall performance may have held back the economy in the fourth quarter of 2022. After yesterday’s bleak retail sales data and considering today’s industrial data, it has become even more likely that GDP contracted significantly on a quarterly basis during the last quarter of 2022.

Going forward, recent global positive news, ranging from pro-growth economic policies in China to improving growth expectations in the US and Europe, all point to strengthening industrial production this year. According to the latest (November) data, the stock of orders was up by almost 20% YoY, which in future should translate into real production activity as global and local economic sentiment improves. In our view, from the second half of this year, industry will become one of the most significant drivers of economic growth.

Download

Download snap