Higher Romanian inflation points to more rate hikes

We anticipated an upside surprise, but the number came in even higher than expected. October inflation reached 7.9% versus our 7.8% estimate. While energy is still to blame - natural gas in particular - it is clear that price increases have become more generalised. We expect year-end inflation at 8.0% and more rate hikes from the central bank

| 7.9% |

July inflation rate |

| Higher than expected | |

Another month, another upside surprise in inflation. The October CPI data confirms that previous (and still to come) energy price increases have been transmitted to the wider economy. For certain, more energy intensive items such as bakery products, price increases have reached a 10-year high, while for other items where seasonality should have had a downward impact - such as fruit - prices have remained sticky to the upside.

However, the most relevant price increases have remained concentrated in the energy sector, with prices for natural gas increasing by 21.2% versus the previous month. This was something that we anticipated, but what we did not anticipate in full - and therefore our 0.1ppt forecast error versus the headline number - was the 6.5% month-on-month increase in fuel prices. The increase is above what we’d estimated for diesel and petrol prices, hence the difference must come from other items included in the fuel category, such as firewood, coal and things that people generally burn and/or can be used as fuel.

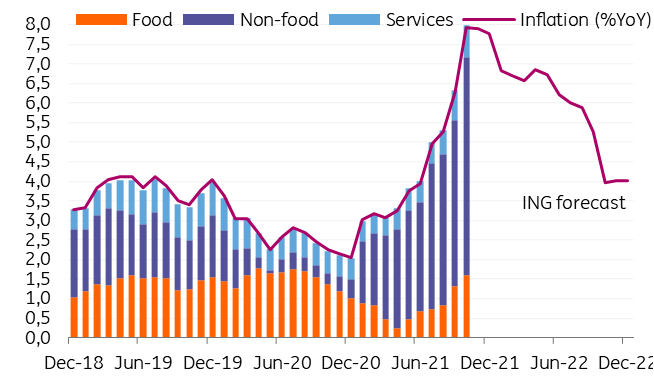

We estimate year-end inflation at 8.0% in 2021 and 4.0% in 2022. Next year’s average inflation should hover in the 5.5%-6.0% range.

Inflation rate (YoY%) and its main components

Tomorrow, 11 November, the National Bank of Romania (NBR) will publish its latest Inflation Report. For now, we know that the updated forecasts show a “significant additional worsening…under the strong impact of supply-side shocks”. In line with our expectations, the NBR sees headline inflation only returning to the 1.5%-3.5% target range in the third quarter of 2023.

An optimist could say that the higher inflation prints now mean stronger disinflationary base effects next year. There is some truth to that, but that’s not how inflation will stay sustainably lower. We believe that the NBR will need to continue with its rate hiking cycle until it reaches a terminal rate of 3.00% in mid-2022. If given the chance, we think that the central bank would like to do less tightening, but the context doesn’t seem to help their wishful dovish stance. In parallel, the FX rate will remain tightly managed and the 4.95 level should hold for most of 2022 as well.

Download

Download snap