Eurozone bank lending to households at 13-year peak

Net lending to businesses remains weak, but this is largely TLTRO-related, and may improve in the months ahead

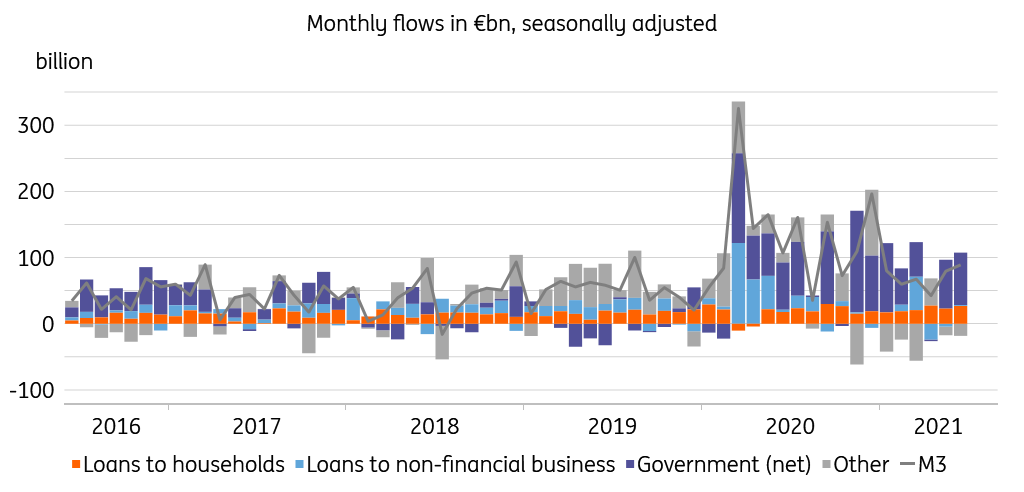

In June, the eurozone M3 money measure increased by €89bn (seasonally adjusted), which is well above the pre-pandemic monthly average, but nothing special since March last year. The main driver continues to be the European Central Bank's asset purchase programme, as it has been since March 2020. In net terms, governments (indirectly, as the ECB only buys on secondary markets) borrowed €79bn from the Eurosystem in June, leading to the equivalent sum in money creation.

Drivers of eurozone M3 money growth

Turning to bank lending, net bank lending to eurozone households remains strong; in fact June net lending surpassed €25bn, registering the highest monthly increase since September 2007. Low interest rates and returning consumer confidence are contributing to buoyant housing markets and mortgage demand in many eurozone countries, as the ECB’s Bank Lending Survey showed last week.

Meanwhile, bank net lending to eurozone businesses turned positive again in June. After the March TLTRO-related lending peak, April and May saw negative net lending, but the effect is now wearing off. Net lending returned to positive territory in France, Italy and Spain, though Germany and the Netherlands contributed negatively. Indeed, a further recovery of cautious business borrowing is to be expected in the months ahead, as the TLTRO effect recedes in all countries and businesses start thinking about investing again, as last week’s Bank Lending Survey indicated.

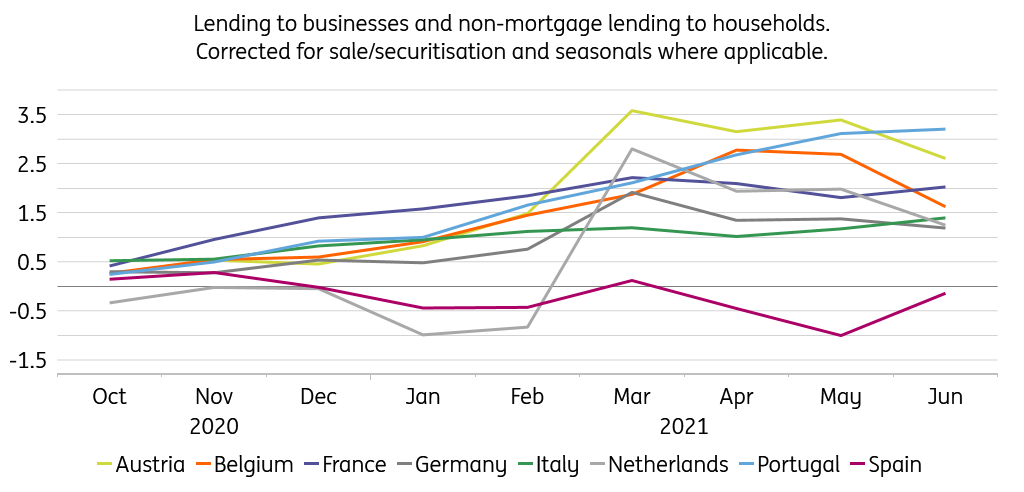

Cumulative TLTRO-eligible bank net lending growth since October '20, %

This also means that banks need not worry too much about their TLTRO lending benchmarks just yet. The “additional special reference period”, measuring borrowing to businesses and non-mortgage borrowing to households, runs until December (and then determines the TLTRO rate received by banks from June this year until June '22. At the country level, the main eurozone economies are all at least 1% above the benchmark right now, with the important exception of Spain, where lending has been weak since autumn last year. As Spanish bank lending did stage a recovery in June, the benchmark is now within reach.

Download

Download snap