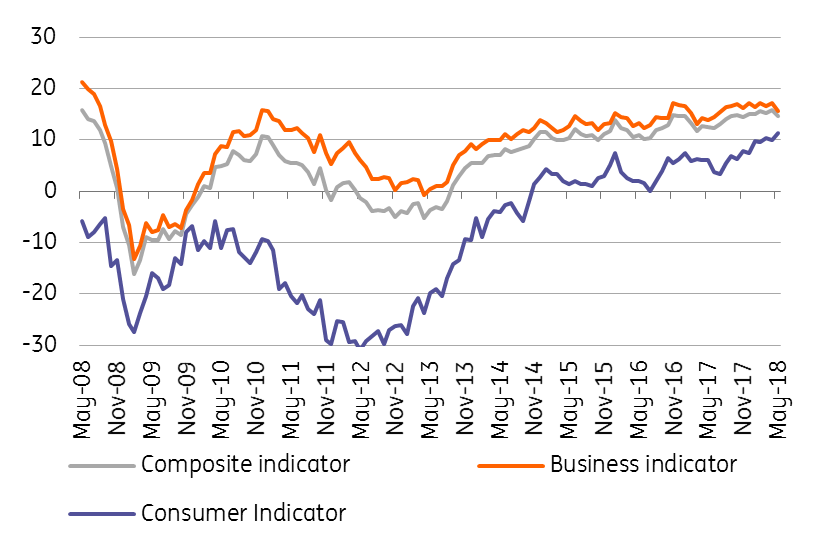

Czech Republic: Consumer confidence at new high in May

Despite latest market volatility and threats about trade-wars, Czech households remain optimistic given favourable labour market and increasing wages. Business confidence declined in May, driven mainly by weaker expectations in industry

Confidence among consumers hits a new high

Czech consumers confidence surprisingly improved further in May, beating the historic March highs. Despite recent market volatility, trade war threats and speculation about an upcoming economic slowdown, this was all rather surprising. It seems that Czech households are benefiting from the current favourable labour market developments, coupled with wage growth, and that's keeping them optimistic. Consumers' concerns about the worsening of the overall economic situation fell slightly in May, as well as worries about rising unemployment.

Confidence Indicators (seasonaly adjusted, points)

Business confidence declined to one-year low

That said, business confidence declined in May to the lowest level since mid-2017 following the trend of leading indicators from Germany and the Eurozone, where latest PMIs have dipped to their lowest level in 18 months. The biggest confidence decline was in the trade and industry sector while services and construction declined just slightly. What is important is that confidence in industry has declined particularly on the back of a worsening production expectations component, yet the assessment of the current situation has almost not changed. Still, in YoY terms, confidence in industry is still higher. In the trade segment, confidence has fallen mainly due to an assessment of current business activity, which is rather surprising given the strong consumer confidence. So it is a question of whether weaker prints were not related to the May holidays and prolonged weekends and does not represent just a one-off.

Flash Eurozone composite PMI shows a further decline in May https://think.ing.com/snaps/expected-re-acceleration-in-eurozone-growth-is-not-happening/

The next hike might come in a few months, due to solid consumption and weak koruna

Although recent confidence indicators show that concerns about the sustainability of current economic developments are starting to increase further, domestic households are currently unaffected and the consumer mood is even increasing. This further confirms that household consumption will be one of the main factors for the growth of the domestic economy this year. Continuing favourable economic conditions, an overheated labour market, and the koruna not delivering monetary tightening in line with the last CNB forecast suggest that the next hike might come sooner than projected by the CNB, that is the last quarter of 2018. As such, we expect it at the August meeting at the latest, and we don't exclude a hike at the end of June meeting if the current koruna weakness continues further.

Download

Download snap